Annual Report

of Yeti GermanCo 1 GmbH 2020

2

Annual Report of Yeti GermanCo 1 GmbH 2020

3

Annual Report of Yeti GermanCo 1 GmbH 2020

4

4 General Information on the Group

10 Economic Report

18 Forecast Report

20 Report on Opportunities

21 Risk Report

25 Risk Management

28

28 Consolidated Income Statement

29 Consolidated Statement of Comprehensive Income

30 Consolidated Statement of Financial Position

32 Consolidated Statement of Changes in Equity

33 Consolidated Statement of Cash Flows

34

56 Notes to the Consolidated Income Statement

66 Notes to the Consolidated Statement of Financial Position

116 Appendix

Content

Group Management Report

of Yeti GermanCo 1 GmbH 2020

Notes to the Consolidated Financial Statements

of Yeti GermanCo 1 GmbH 2020

Consolidated Financial Statements

of Yeti GermanCo 1 GmbH 2020

4

Annual Report of Yeti GermanCo 1 GmbH 2020

Overview of the Messer Industries Group

Yeti GermanCo 1 GmbH (the “company”) is a holding company based in Sulzbach (Taunus) near Frankfurt/

Main with a business address in Bad Soden am Taunus. It operates as a financial holding company and,

together with its subsidiaries, associates and joint ventures, forms the Messer Industries Group (the “Group”).

Yeti GermanCo 1 GmbH was founded as a joint venture company by Messer Group GmbH and CVC Capital

Partners, with the purpose of assuming the management of the businesses in the Americas (“Messer

Americas”) acquired from Linde and Praxair as of March 1, 2019 and the businesses in Western Europe

(“Messer Western Europe”) contributed by Messer. In this context, Messer Group GmbH has contributed

its Western European operating activities in Spain, Portugal, Switzerland, France, Belgium, the Netherlands,

Denmark, Germany and the company in Algeria, plus a right-of-use asset for the “Messer – Gases for Life”

brand, to the joint venture for a period of ten years as of March 1, 2019. Yeti GermanCo 1 GmbH has its

own subsidiaries in Western Europe, North and South America.

Founded in 1898, Messer is today the world’s largest family-operated specialist for industrial, medical and

specialty gases. Products and services are offered in Europe, Asia and the Americas under the “Messer –

Gases for Life” brand.

From acetylene to xenon, the Messer Industries Group offers a wide-ranging industrial and medical gas

product portfolio – the company produces industrial gases such as oxygen, nitrogen, argon, carbon dioxide,

hydrogen, helium, welding shielding gases, specialty gases, medical gases and many different gas mixtures.

General Information on the Group

Group Management Report

of Yeti GermanCo 1 GmbH 2020

5

Annual Report of Yeti GermanCo 1 GmbH 2020

Changes in group reporting in fiscal 2020

The consolidated group was unchanged in the past fiscal year.

Financial performance indicators

The Messer Industries Group uses control parameters derived from operating performance indicators to

manage its business. The most significant performance indicators are revenue, EBITDA, capital expendi-

ture and net debt. Further explanations and a breakdown of indicators can be found in the sections on

financial performance and financial position.

Non-financial performance indicators*

Safety, health, environmental protection and quality (SHEQ) have been firmly embedded in the family-

operated Messer’s guiding principles since its inception in 1898, and continue to be its top priority today

– especially in the context of the COVID-19 pandemic. Messer is aware that well-organized safety and

quality guidelines form the basis for handling operational risks safely and for improving operational perfor-

mance. For this reason, the health and safety of our employees and environmental protection are an integral

part of global quality management, which is reflected in various standards of the Messer Industries Group,

which were revised again against the backdrop of the COVID-19 pandemic to help effectively counter it.

The following information on non-financial performance indicators relates to the Group as a whole.

Occupational safety

Occupational safety is of great importance to the Messer Industries Group. Messer’s safety guidelines

reflect our position: “All work-related illnesses, injuries and accidents are avoidable.”

Messer uses its management system to identify and control possible operational risks. The principles of

this system are documented in a SHEQ manual and cover all relevant safety-related areas, such as risk

management, safety training, safety tests, Personnel protective equipment, communication safety and

accident investigation. The SHEQ manual is a part of compliance management at the Messer Industries

Group and is updated and improved regularly.

In order to measure the success of the safety measures and initiatives, the following performance indicators

are determined annually: work accidents with lost days and frequency of accidents (number of work-related

accidents with lost days per million working hours) and accident severity rate (missing days per million

working hours).

In 2020, 19 work accidents with lost days were reported in the Americas (previous year: 18) and 4 (previous

year: 10) in Western Europe.

* The content of this section is voluntary and unaudited, but has been read critically by the auditor.

6

Annual Report of Yeti GermanCo 1 GmbH 2020

The absenteeism rate of employees per million hours worked (accident frequency) was 1.7 (previous

year: 1.6) in the Americas in 2020 and 2.9 (previous year: 7.1) in Western Europe, while the number of

days lost (accident severity) was 27.8 (previous year: 21.6) per million hours in the Americas and 34.4

(previous year: 186.4) in Western Europe.

Messer Western Europe is an active member of the European Industrial Gas Association (EIGA) and the

International Oxygen Manufacturers Association („IOMA“) and Messer North America of the Compressed

Gas Association (CGA) and the American Chemistry Council (ACC). Our experts actively share experiences

and knowledge in order to learn from incidents in the industrial gas sector.

Transport safety

The transportation of gases and equipment by road and customer deliveries are activities that involve major

risks in the gas industry. Messer therefore pays special attention to the area of transport safety.

Most of the drivers who work for Messer in Europe are employed by external transport companies. These

companies are responsible for training the drivers in accordance with the ADR (European Agreement

concerning the International Carriage of Dangerous Goods by Road). In 2020, the number of avoidable

accidents when transporting our cylinder gases was 53 in the Americas (previous year: –) and four in

Western Europe (previous year: two). For every million kilometers driven, this corresponds to a frequency

rate of 6.1 in the Americas (previous year: –) and 0.65 in Western Europe (previous year: 0.29). The data for

the Americas were collected for the first time in 2020.

The number of avoidable accidents while transporting liquefied gases was 152 in the Americas (previous

year: 120) and nine in Western Europe (previous year: three); the frequency rate per million kilometers

driven in 2020 was 1.23 in the Americas (previous year: –) and 0.5 in Western Europe (previous year: 0.17).

Messer is endeavoring to reduce the number of accidents with the help of suitable supplier management,

information on defensive driving and load safety. Messer has also created its own modular driver training

package. The main issues covered by the training are:

• Statutory regulations (European and national regulations for the transport of dangerous goods by road)

• Technical aspects (hazards arising from product, vehicle and tank technology, vehicle checks, safety

technology)

• Accident avoidance

• Defensive, economic driving

In addition, all drivers receive a manual specifically for their work (bulk, bottle or service vehicles). This

ensures that the drivers have all the key information about their work to hand at all times.

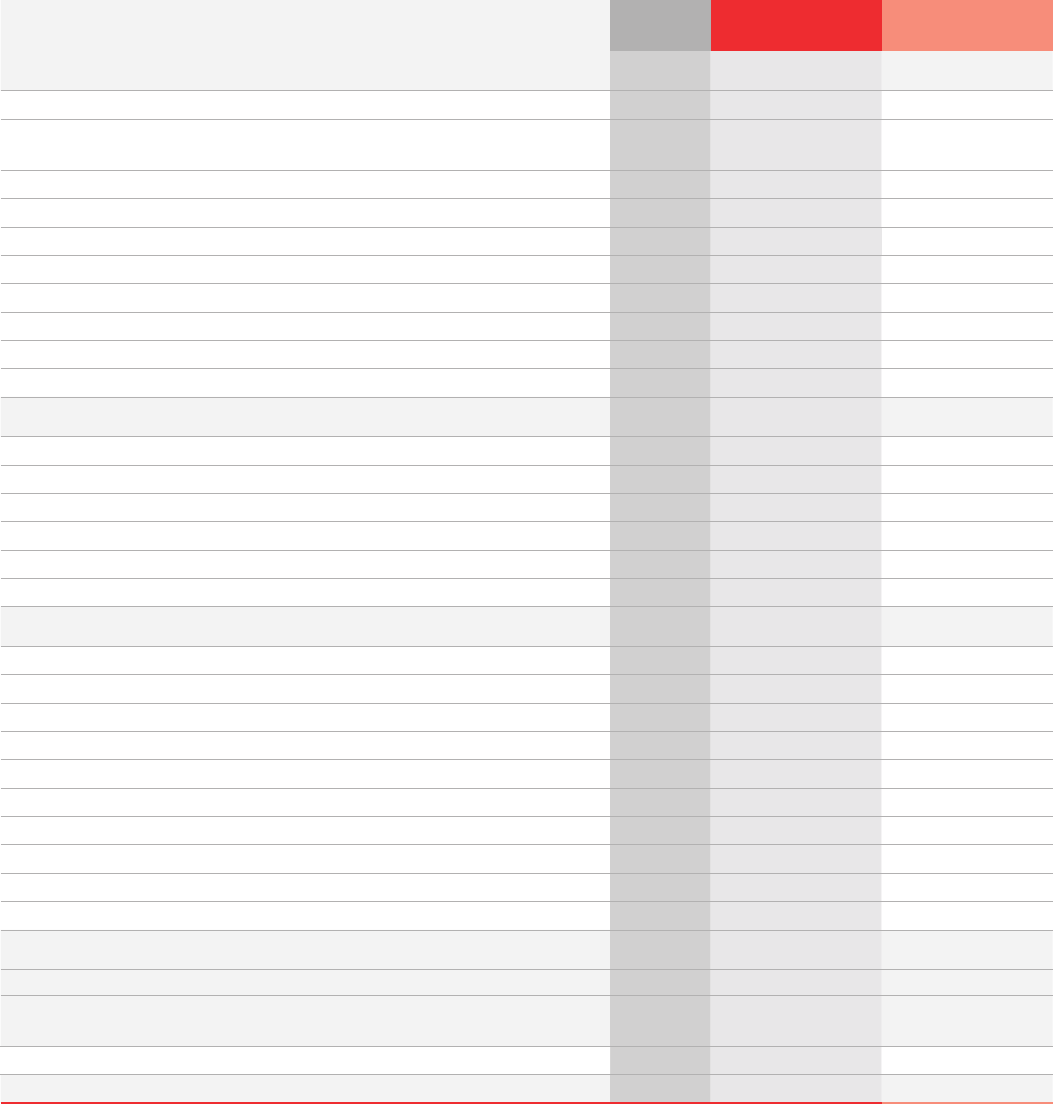

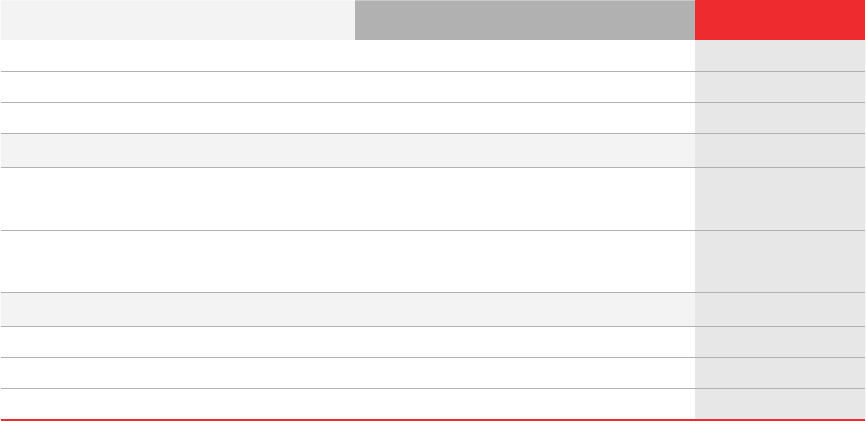

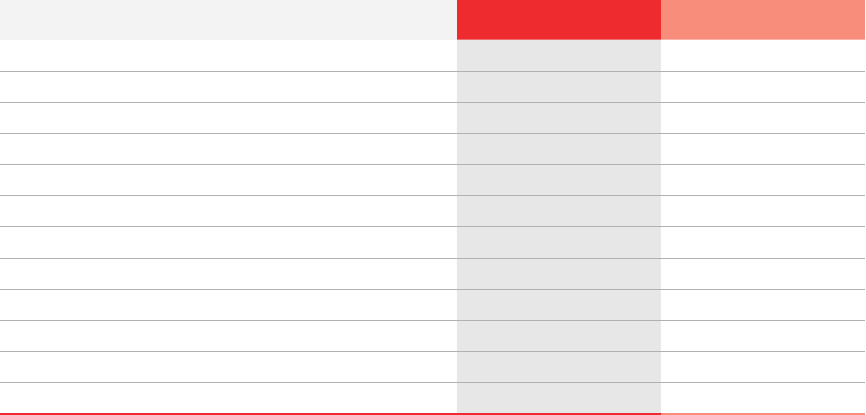

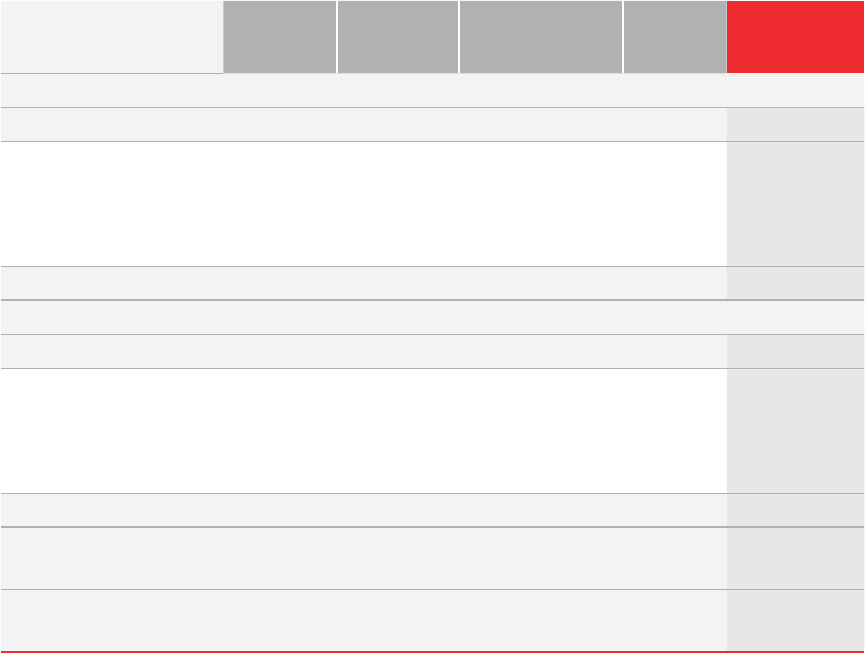

2020 Americas / WEU 2019 Americas / WEU 2018 Americas / WEU

Working accidents with lost days 19 / 4 18 / 10 −

Accident rate* 1.7 / 2.9 1.6 / 7.1 −

Accident severity* 27.8 / 34.4 21.6 / 186.4 −

* per million hours worked

7

Annual Report of Yeti GermanCo 1 GmbH 2020

Digitization and IT security

Digitization is becoming increasingly important within the Messer Industries Group. The duties of the Group

Digital Officer (GDO) and the Group Security Officer (GSO) are performed by the Messer Industries Group

for Messer Western Europe. They implement Messer’s standards with a large number of projects and

advise the central functions and national subsidiaries in these areas.

At the Messer Group, the GSO is responsible for coordinating security measures, setting standards and

cultivating the corresponding expertise for all the individual companies. IT security supports the sustainability

of our digitization and the physical security of our information, in addition to helping to ensure that our key

business processes can be carried out by safeguarding the vitally necessary availability of our systems. IT

security services are devised by the IT Security team and its international members.

In the period under review, an agreement was signed to outsource most of the applications previously run

at the Messer Information Services data center in Gross-Umstadt, Germany. The goal of the cooperation is

the strategic and technical reorganization of the Messer Group’s IT infrastructure – in line with the current,

globally established standards – to make the IT infrastructure more powerful, more stable and more secure,

and thereby to create the central requirements for further efficiency enhancements and process impro-

vements. Uniformly high security standards will be implemented in conjunction with the project. Between

December 2020 and provisionally June 2021, all locations of the Messer Group and Messer Western Europe

will be connected to the IBM data center. The existing, and highly mixed, security infrastructure at the

locations will be standardized and placed under the uniform central management of a team of the outsour-

cing partner’s experts.

Outdated versions of MS Office will be replaced by Office 365. In the future, all client PCs will be provided

with central security updates and standardized, state-of-the-art software; also – as for the in-house smart-

phones – they will be administered centrally.

As part of the first wave in kicking off an IT security campaign, phishing e-mails were sent to management

and IT staff in Europe. The phishing campaign will be continued in 2021 and employees will be trained in the

risks of cybercrime using an awareness platform. We are thus reducing the potential risks and improving the

knowledge of our employees.

Messer Americas is constantly investigating the strategic possibilities of digitization and developing a

framework concept for information services to enable the companies to grow continuously. Essential

aspects that are examined as part of this concept are business applications, technical infrastructure, Internet

security and system management and organization. Within the company applications and the technical

infrastructure, applications such as SAP S / 4HANA or GOLD Suite are promoted, cloud-based services are

increasingly used and the efficiency in the areas of business processing, automation and data management

is examined. Internet security is an integral part of risk management, while protecting sensitive data is the

top priority. Our employees therefore receiving ongoing awareness training for these issues. Management

and organization are responsible for increasing efficiency within information services while at the same time

ensuring excellent service.

8

Annual Report of Yeti GermanCo 1 GmbH 2020

Data protection

Messer is committed to compliance with the applicable data protection regulations. Corresponding structures

are therefore created to guarantee a high level of data protection at Messer in the long term.

The Messer Group Privacy Officer (GPO), who is committed to continuing and optimizing data protection,

is responsible for the strategic coordination of the central data protection department at Messer and also

oversees the implementation of data protection by the national subsidiaries. The GPO also provides a number

of templates and processes to ensure a uniform standard of data protection.

A basic audit to establish the fundamental data protection level in the respective company was made

possible using a list of questions developed by the GPO. In Western Europe, data protection audits are

planned for three companies for the first time in 2021.

In order to further raise awareness of the threat posed by cybercrime, the GPO, together with the Group

Legal department, has developed an e-learning on cybercrime and made it available to the national companies

in Europe.

The data protection provisions are covered both in the Messer Group’s Code of Conduct and a supplement

to the Code for Messer Americas. In addition to this, Messer Americas has also created its own Data

Protection Policy that can be accessed on its Compliance website. The contacts for data protection issues

are the Senior Counsel and Regional Compliance Officer of Messer Americas and the Head of Human

Resources for North America. Staff throughout the Americas can also contact the members of the Legal and

Compliance team if they have any questions or concerns regarding data protection. Messer Americas also

consults with external legal experts on compliance matters in South America in particular. The “Ethics and

Code of Conduct” e-learning also contains a data protection module that must be completed for all emplo-

yees of Messer Americas.

Environmental management

Environmental protection, at all times and everywhere, is highly important to Messer. To live up to this,

Messer uses its global management system for environmental protection. The internal environmental

protection policies are documented in the Messer Industries Group’s SHEQ Manual. The environmental

management systems of the Western European and American subsidiaries are consistent with the internati-

onal ISO 14001 standard, and those of the Western European companies also adhere to the recommenda-

tions of the European Industrial Gases Association (e.g. EIGA IGC Doc. 107 – Guidelines on Environmental

Management Systems). In 2020, five of our subsidiaries in Western Europe had their environmental

management systems externally certified. Messer Americas follows the American Chemistry Council’s

Responsible Care Program, under which 35 locations in the US are certified. Two air separation units and a

CO

2

production site in Colombia are ISO 14001- and OHSAS 18001-certified, and four locations are ISO

14001-certified in Brazil.

The efficient use of energy is in Messer’s own interests. Pursuing the main goal of reducing costs and

conserving resources, energy management is an ongoing process that also helps to reduce our carbon

emissions. Our energy management system, for example, is certified according to ISO 50001 at all Messer

production sites in Germany and Spain.

9

Annual Report of Yeti GermanCo 1 GmbH 2020

At its production sites, Messer uses atmospheric air and electricity as the main raw materials for producing

air gases such as nitrogen, oxygen and argon. Production by air separation units accounts for more than

75 % of total energy consumption. Particular emphasis is therefore placed on the ongoing enhancement of

energy efficiency. Messer Group GmbH has thus engaged a Global Energy Manager (GEO) specifically to

improve the energy efficiency of air separation units. The GEO also performs this task for the Western

European companies of the Messer Industries Group.

The continuous monitoring of unit performance means that deviations in energy consumption can be

detected and potential for improvement identified. In cooperation with local managers, projects to improve

energy efficiency are being initiated on an ongoing basis.

Since joining the European Clean Energy Alliance in 2020, Messer can contribute its comprehensive

expertise in the field of industrial gases in the interests of the efficient and effective use of green hydrogen

with partners throughout Europe.

Customer satisfaction / quality

Taking the opinions and satisfaction of our customers into account is self-evident for us as a responsible

company, which is why we measure customer satisfaction in systematic surveys and integrate the results

into our management processes. The analysis of customer satisfaction is repeated every two years at every

European national company.

In Western Europe, customer satisfaction surveys were carried out in France, Switzerland and Spain (previous

year: France). In total, 9,760 customers were asked to complete the survey, which yielded 1,032 responses.

The results of the various surveys are summarized by region. On a scale from 1 for very dissatisfied to 10

for very satisfied, the overall performance of the Messer Industries Group in Western Europe has improved

year-on-year to between 8.9 and 9.4 (previous year: 8.0). The results are at a high level overall.

In the Americas, satisfaction surveys were performed for the first time in the US and Brazil in 2020. 29,009

questionnaires were sent out, 3,037 of which were analyzed. Customer satisfaction for the Americas region

was rated 5.6.

10

Annual Report of Yeti GermanCo 1 GmbH 2020

Economic Report

General economic conditions

The various industrial gases and the associated services and technologies are used in almost all industrial

sectors, not to mention food technology, medicine, research and science. Gross domestic product (GDP),

as it applies to all sectors and to the economy at large, is therefore a relevant indicator for the performan-

ce of the Messer Industries Group.

The World Health Organization (WHO) classified coronavirus (COVID-19) as a public health risk on Janua ry

30, 2020. The virus then quickly developed into a pandemic with serious repercussions worldwide. The

measures to contain the COVID-19 pandemic and to protect the health of society led to temporarily neces-

sary restrictions in everyday life and thus business life as well all over the world. As a result, according to

estimates by the International Monetary Fund (IMF)

1

and the World Bank

2

, global economic growth slum-

ped by around -4 % on average. According to the World Bank, for instance, real global GDP is believed to

have contracted by -4.3 % in 2020, after having expanded by 2.3 % in 2019. The massive economic crash

was evident in the industrialized nations and the emerging markets alike. Within the industrialized nations,

the downturn in the euro area has been even more pronounced than in the US. The economic slump has

meant a return to two different rates of GDP growth, estimated by the IMF at -2.4 % (2019: 3.6 %) for the

emerging markets and -4.9 % (2019: 1.6 %) for industrialized nations in 2020.

1

The relatively moderate

economic downturn on the emerging markets is largely thanks to China, which is also the only major eco-

nomy expected to have generated GDP growth in 2020.

The 2020 economic performance in Europe was defined by a massive slump in industrial production as of

the end of the first quarter, which would go on to bottom out during the second quarter. This was followed

by a process of recovery that, by as early as the end of the third quarter, brought consumer spending back

to the level of when the year began, though industrial production was not yet able to return to the level at

which it started the year. The recovery process then suffered a tangible setback with the start of the fourth

quarter and the second wave of the COVID-19 pandemic. According to the Organization for Cooperation and

Development (OECD)

3

, GDP for the euro area is believed to have crashed by -7.5 % in 2020 after a minor

increase of 1.3 % the year before. As a result, above all the larger Western European economic areas such

as France, Italy and Spain suffered the severest economic slumps of between -9 % and -12 % of GDP, while

Germany’s GDP downturn is expected to match the OECD’s average of -5.5 %. In Eastern Europe, GDP

frequently slumped to below the euro area average (-7.5 %), though in some countries GDP fell by less than

the OECD average (-5.5 %), for instance Poland at -3.5 % or Bulgaria at -4.1 % of GDP.

In China, where the COVID-19 pandemic first began, the economic downturn commenced just as the year

began and reached its lowest point at the end of the first quarter. By as soon as the second quarter, the

strict measures taken by the Chinese government to contain the pandemic started to have an effect and –

according to official sources – the virus was largely under control by the middle of the year. As a result,

China is expected to report GDP growth for 2020 as a whole, possibly of 2.0 % according to World Bank

estimates (2019: 6.1 %). The Chinese government’s general goal of reducing its dependence on exports by

strengthening domestic demand with a corresponding focus on consumer spending and services was

1

World Economic Outlook, Update January 2021

2

Global Economic Prospects, January 2021

3

OECD Economic Outlook – Volume 2020 Issue 2

11

Annual Report of Yeti GermanCo 1 GmbH 2020

advanced further, particularly in view of the escalating trade conflict with the US. In this context, the

government stepped up its support for infrastructure projects especially.

In the US, the impact on economic development of the COVID-19 pandemic occurred in parallel to that in

Europe, thus a massive economic slump in the first half of 2020 was followed in the third quarter by a

recovery spurred by fiscal stimulus for private households. According to the IMF

4

, GDP for 2020 as a whole

is expected to have collapsed by -3.4 %, following growth of 2.2 % in 2019. Production in particular was

negatively impacted by the trade conflict with China and, in part, Europe as well, which escalated in 2020.

The IMF is projecting a more impactful drop in GDP of -4.5 % in Brazil, though the country had achieved

slight growth of 1.4 % in 2019.

Business performance

Industrial gases business is defined by a pronounced and highly varied diversification across economic

sectors, customer segments and national activities. Furthermore, industrial gases business is locally

structured, which means that it is not directly dependent on global supply chains. The restrictions to curb the

COVID-19 pandemic, some of which were massive at times, increasingly focused on the leisure and travel

sectors as 2020 progressed, and less on the industrial activities that are more significant to industrial gas

operations. To a certain extent, there was also an isolated boom in the medical, foodstuffs and electronics

segments.

For the Messer Industries Group, fiscal 2020 was defined by an economic crash in Europe as a result of the

COVID-19 pandemic, which hit Western Europe harder than most Eastern European countries. The early

temporary business closures in North America led to a decline in demand for industrial gases coupled with

a rising need for medical oxygen. A tangible recovery was apparent on many markets during the summer

months, with some even returning to their original prepandemic levels before the end of the year. South

American business activities remained strong throughout the whole of the year, in particular because the

need for healthcare services and medical oxygen outstripped the downturn in demand for industrial gases.

The Brazilian economy proved robust on most markets in spite of the COVID-19 pandemic.

The Messer Industries Group was founded in fiscal 2018, and began operating effective March 1, 2019

following the acquisition and contribution of business in the Americas and Western Europe. Without

adjusting for this limited comparability, the Messer Industries Group generated significant revenue growth

of more than 16.5 % to K€ 1,965,492. In line with this revenue development, EBITDA was 45.1 % higher

than in 2019 at K€ 541,040. However, the change as against the previous year is largely due to the different

comparative period for operating activities.

The net debt of the Messer Industries Group was down on the previous year at K€ 1,946,309 (previous

year: K€ 1,948,833) thanks to the higher consolidated net profit and despite higher tax payments in the US.

The Messer Industries Group brought the fiscal year to a satisfactory conclusion with revenue of K€ 1,965,492

and EBITDA of K€ 541,040.

4

World Economic Outlook, Update January 2021

12

Annual Report of Yeti GermanCo 1 GmbH 2020

A slight increase in the Group’s revenue was forecast in the previous year. As stated above, revenue rose by

16.5 %, though it should be noted that the Messer Industries Group did not commence operating activities

until effective March 1, 2019. If one assumes that the Group had been operational for twelve months in

2019, revenue would have been down slightly in 2020 on account of the weak US dollar and Brazilian real.

Adjusting for this effect, revenue increased slightly and thus the forecast was achieved.

A slight increase in EBITDA was also forecast in the previous year. If one assumes that the Group had been

operational for twelve months in 2019 here as well, EBITDA would have risen by about 21 %. This positive

development largely results from favorable purchasing conditions for helium, successful cost management

in conjunction with the pandemic and a dynamic overall business performance, especially in the field of

medical gases.

While a slight increase had been forecast, the net debt of the Messer Industries Group was reduced slightly

in 2020 thanks to the high earnings in the fiscal year and in spite of high tax payments.

Translated into euro, the Messer Industries Group’s capital expenditure was slightly less than in the previous

year. However, adjusted for currency effects, capital expenditure increased in line with planning.

Overall situation of the Messer Industries Group

Results of operations

In fiscal 2020, the Group generated global revenue of K€ 1,965,492 (previous year: K€ 1,687,608), which

breaks down among the individual regions as follows:

Business activities in the various regions developed as follows:

North America

North America generated revenue of € 1,353 million. This positive development was buoyed by strong

pricing and a higher demand volume in specialty and medical gases. The slump in demand in the segments

affected by COVID-19 was therefore more than offset.

Western Europe

The revenue of the Western European companies was up by € 58 million as against the previous year at

€ 354 million. In addition to temporary business closures in all Western European countries on account of

the COVID-19 pandemic, this figure was influenced by a serious accident at a main pipeline customer in

Tarragona, Spain. These factors led to a decline in revenue, above all in the fields of liquefied gases and

on-site plants. An offsetting effect that compensated almost entirely for this decline resulted from success-

ful pricing in fiscal 2020. Revenue increases in medical gases, specialty gases, hardware and cylinder rental

made up for the weaker revenue from pipeline and liquefied gases business.

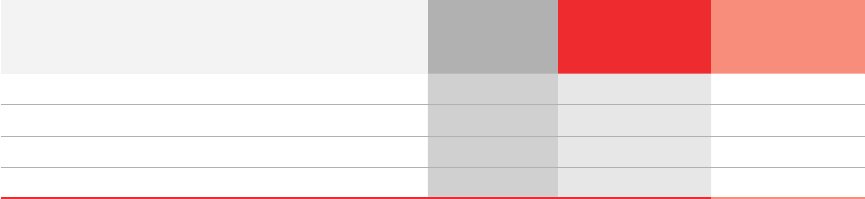

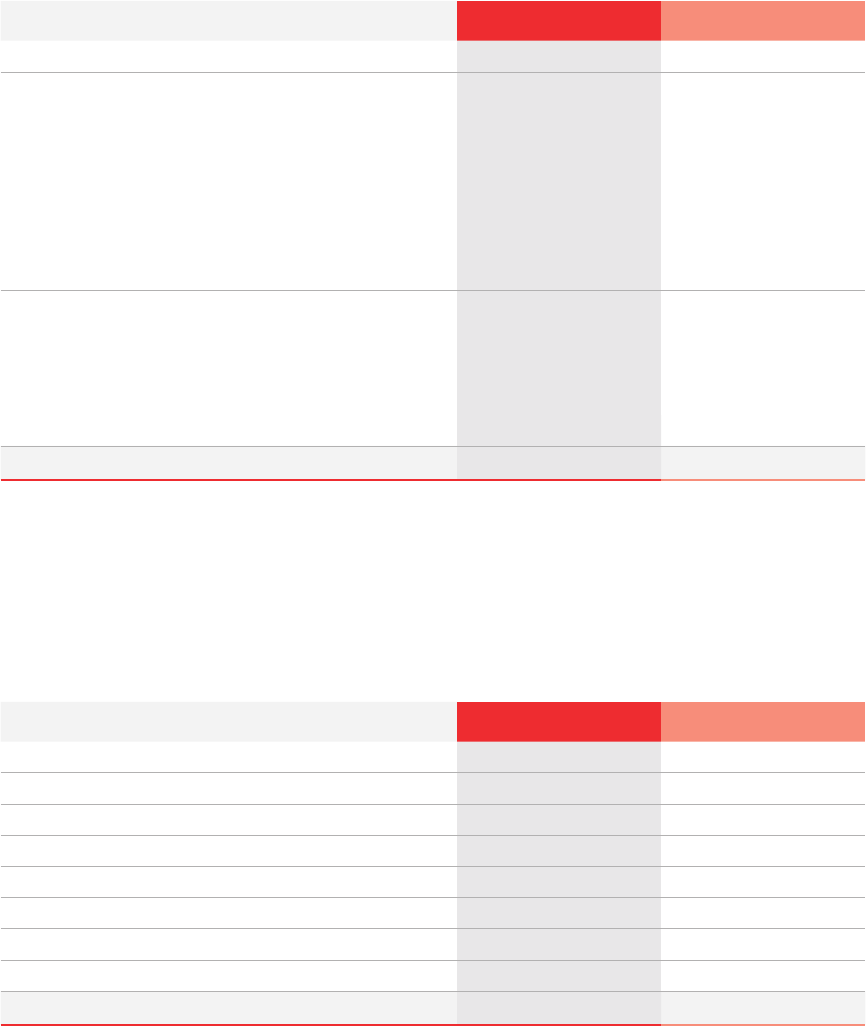

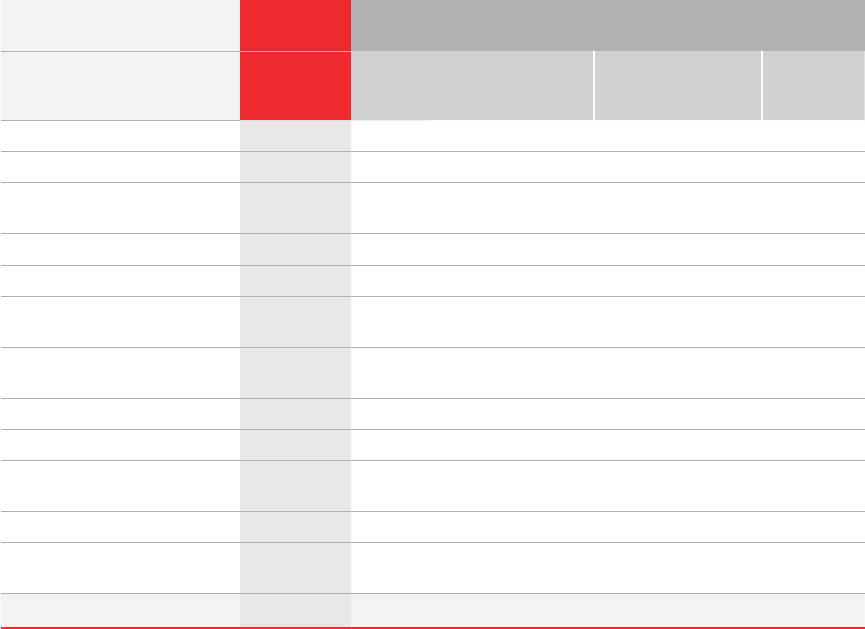

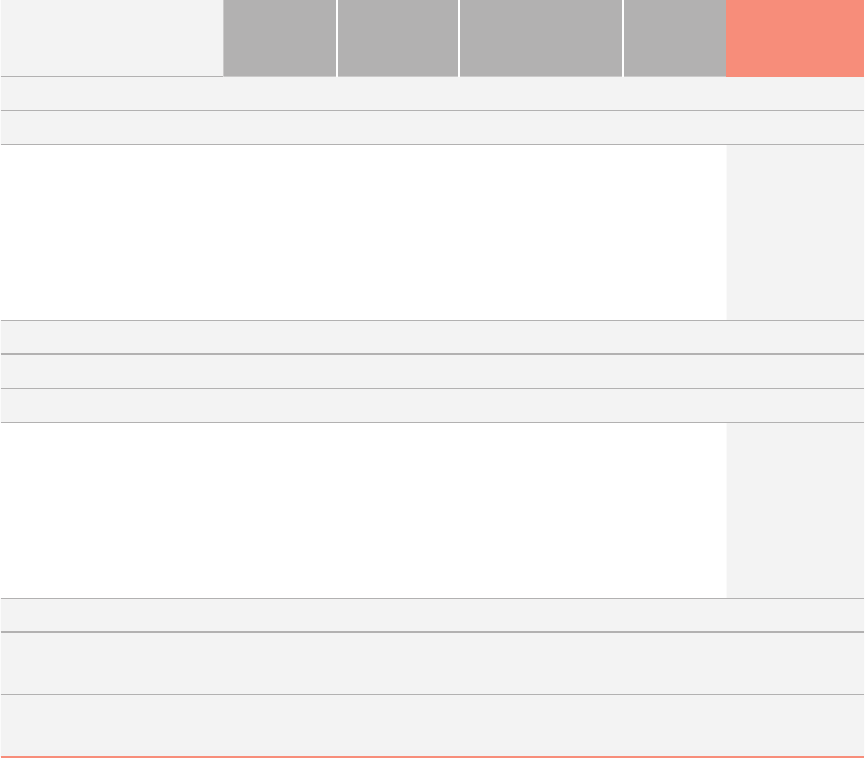

Revenue

Jan. 1 -

Dec. 31, 2020

Jan. 1 -

Dec. 31, 2019

Change in 2020

North America 1,353,366 1,142,224 18.5 %

Western Europe 353,677 296,249 19.4 %

South America 258,449 249,135 3.7 %

Total 1,965,492 1,687,608 16.5 %

13

Annual Report of Yeti GermanCo 1 GmbH 2020

South America

The South America division generated revenue of € 258 million (previous year: € 249 million), a significant

share of which was again contributed by Brazil at € 150 million (previous year: € 153 million). Revenue

was characterized by very strong demand for medical oxygen, combined with ongoing sales volume and

price increases in most business segments. The notional revenue increase of 4 % in South America is

offset by the substantial depreciation of the Brazilian real against the euro.

The Group generated global EBITDA of K€ 541,040 in fiscal 2020 (previous year: K€ 372,819).

As a negative effect, the operating profit essentially includes the costs of sales of K€ 1,001,068 (previous

year: K€ 871,564), selling and distribution expenses of K€ 588,614 (previous year: K€ 542,604) and general

and administrative expenses of K€ 181,113 (previous year: K€ 169,558).

The EBITDA of the North America region improved to € 371 million (EBITDA margin: 27.4 %) after € 250

million in the previous year with an EBITDA margin of 21.9 %. This development is essentially thanks to

demand for products in segments with higher margins, flexibility in supply chains to reduce variable costs in

line with the decline in demand and strict cost management. The previous year’s EBITDA was squeezed by

transaction and demerger costs in connection with the acquisition of activities from Linde and Praxair.

Western Europe generated EBITDA of € 95 million (previous year: € 61 million), corresponding to an EBITDA

margin of 26.9 % (previous year: 20.6 %). There were positive effects as a result of successful pricing and

cost savings in the areas of HR, travel expenses and external consulting services. Offsetting effects arose

from a provision for legal matters in connection with energy deliveries in Spain in the amount of € 5.4 million.

South America reported EBITDA of € 75 million (previous year: € 62 million) with an EBITDA margin of 29 %

(previous year: 24.9 %) in fiscal 2020, which – as in the previous year – was largely thanks to a rise in sales

volumes and a solid price recovery despite cost pressure. Offsetting this, EBITDA in euro was hit hard by the

substantial depreciation of the Brazilian real.

At K€ 85,816 (previous year: K€ 83,796), the net financial result is largely due to a negative net interest result.

€ 19 million of the financial liabilities raised in the previous year, essentially to finance the Linde / Praxair

transaction, were repaid during the year.

In total, a consolidated net profit including non-controlling interests of K€ 52,461 (previous year: K€ 3,209)

was generated in fiscal 2020. K€ 51,737 (previous year: K€ 2,695) of this relates to the shareholders of the

parent company.

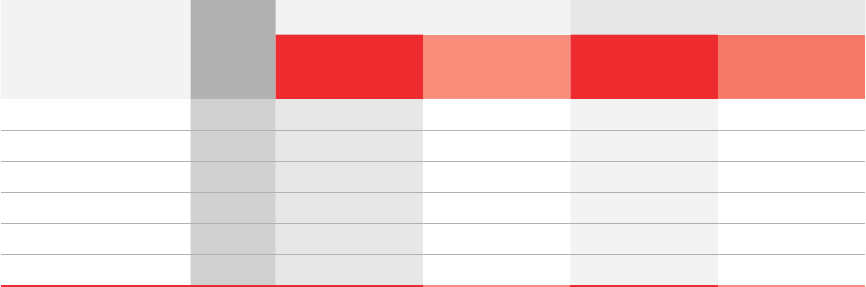

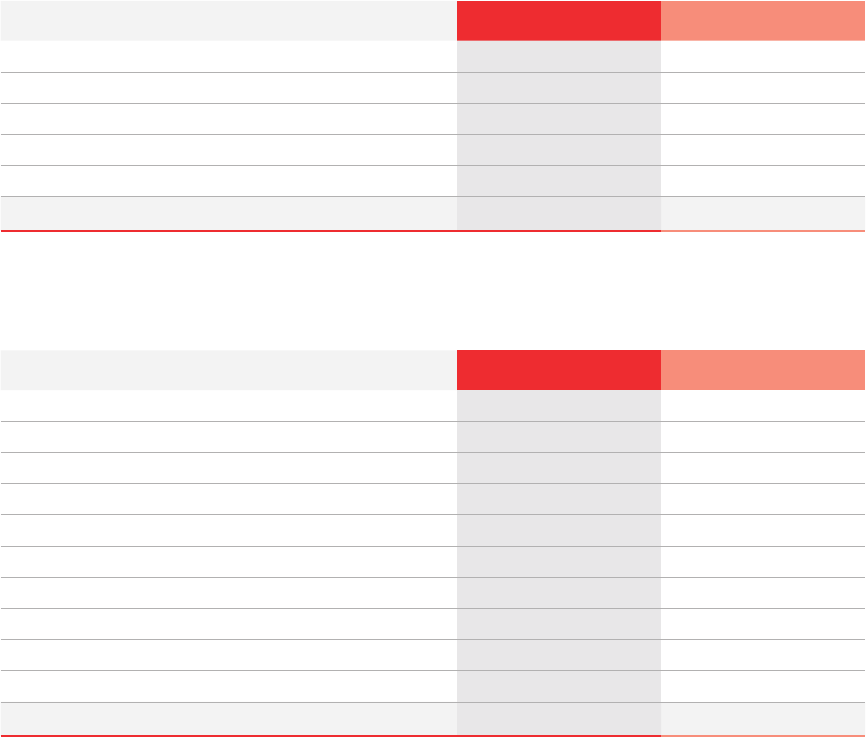

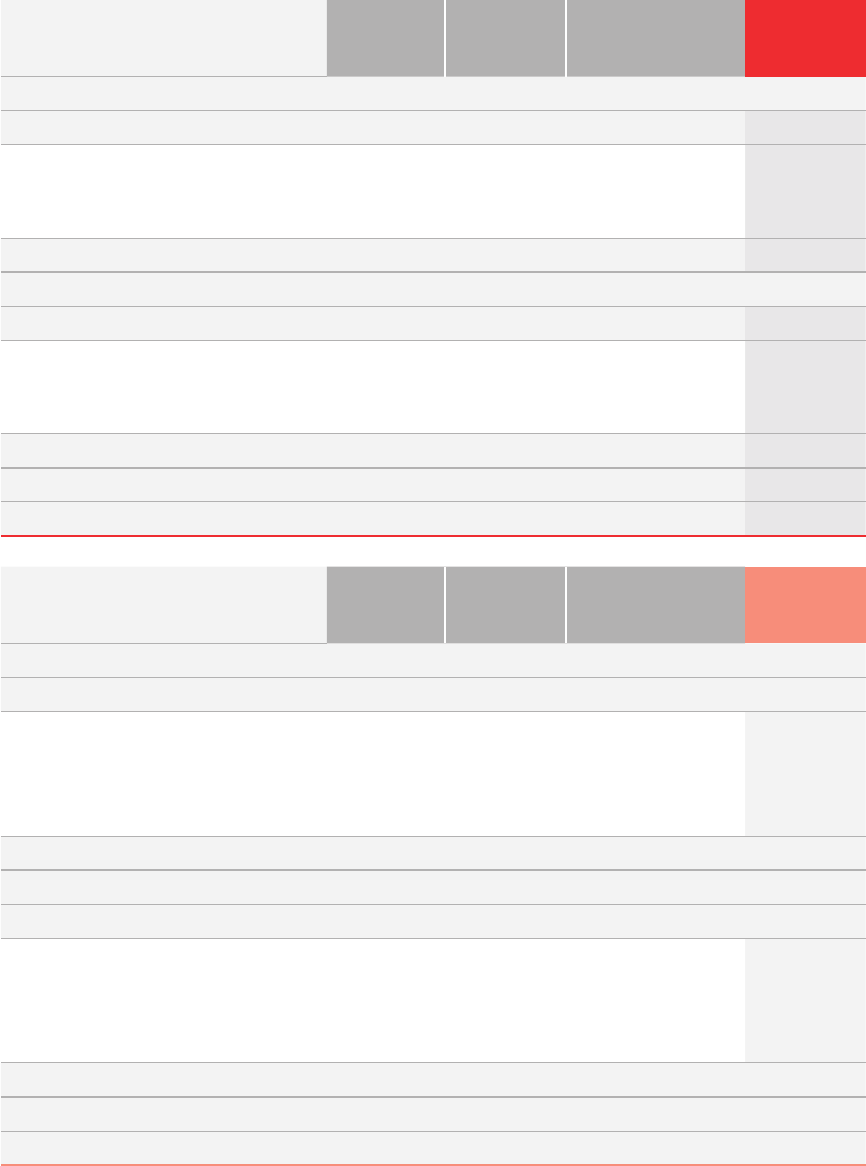

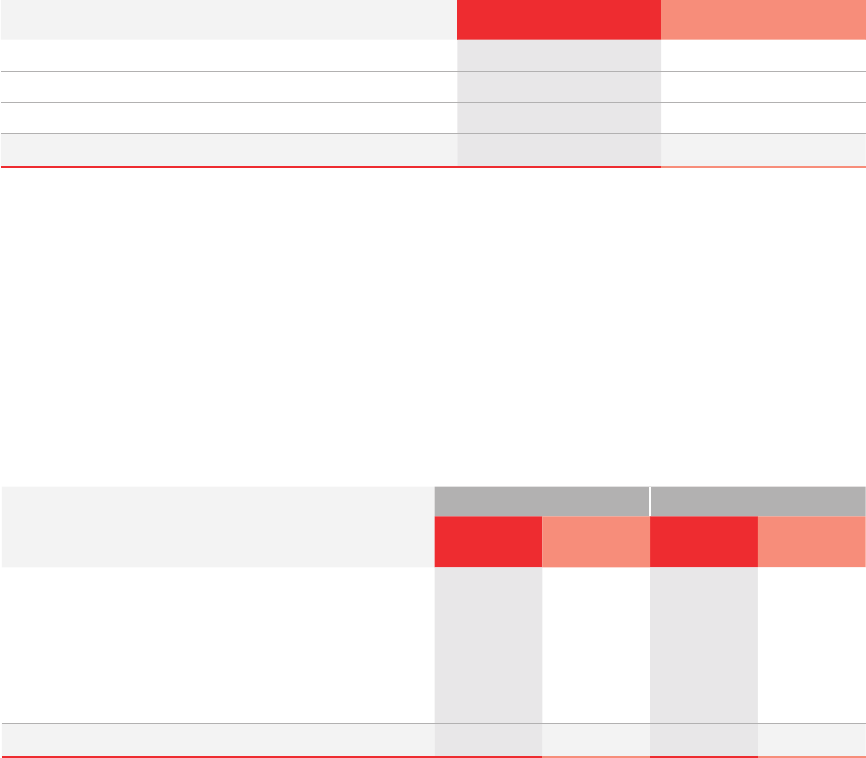

EBITDA

Jan. 1 - Dec. 31, 2020 Jan. 1 - Dec. 31, 2019

Operating profit / EBIT 194,982 80,215

Depreciation of property, plant and equipment, amortization

of intangible assets and impairment

346,058 292,604

EBITDA 541,040 372,819

Revenue 1.965,492 1,687,608

Margin: 27.5 % 22.1 %

14

Annual Report of Yeti GermanCo 1 GmbH 2020

Financial position

Group Treasury is responsible for overall liquidity, interest rate and currency management. The most import-

ant objective for Group Treasury is to ensure that the Group has a minimum level of liquidity to guarantee

solvency at all times. High levels of cash funds improve our flexibility, security and independence. We can

generate additional liquidity as necessary through various other unutilized credit facilities amounting to

€ 290 million (previous year: € 279 million).

Financing

The Messer Industries Group is financed by a credit agreement with a syndicate of banks headed by

CITIBANK N.A., UK.

The loan agreement serves to partially finance the purchase price payment for the Linde AG and Praxair

business acquired in North and South America in 2019 and to finance ongoing business operations.

The credit agreement contains three facilities:

• “Facility B-1” of USD 2,225 million, a long-term, fully utilized loan with a term of seven years. The borrower

is Messer Industries USA, Inc., Delaware. The loan will be repaid quarterly at 0.25% of the original amount,

starting on June 28, 2019. The balance will be repaid in full on March 1, 2026. The margin is 2.5 % p.a. or

1.5 % p.a. depending on the underlying refinancing base of the banks.

• “Facility B-2” of € 540 million, a long-term, fully utilized loan with a term of seven years. The borrower is

Messer Industries GmbH. The loan is due on March 1, 2026. The margin was initially 2.75 % p.a., until

August 28, 2019, since when it has been subject to an adjustment mechanism based on the development

of the ratio of senior net debt to consolidated EBITDA.

• “Revolving facility” of USD 450 million: The borrowers are Messer Industries GmbH and Messer Industries

USA, Inc., Delaware, and any other company that secures the loan agreement as a guarantor. The facility

can be used to finance working capital and for all general financing requirements of the company on a

revolving basis. There is no need to reduce the loan to zero at any time during its term. It is available until

March 1, 2024. The margin was 1.75% p.a. or 0.75 % p.a., depending on the underlying refinancing base

of the banks, until August 28, 2019, since when it has been subject to an adjustment mechanism based

on the development of the ratio of senior net debt to consolidated EBITDA. The facility of € 290 million

was unutilized as of December 31, 2020.

Guarantees provided by individual Group companies serve as collateral for the financing. Investments in

Group companies, property, plant and equipment, bank balances, trade receivables and receivables from

affiliated companies were also pledged.

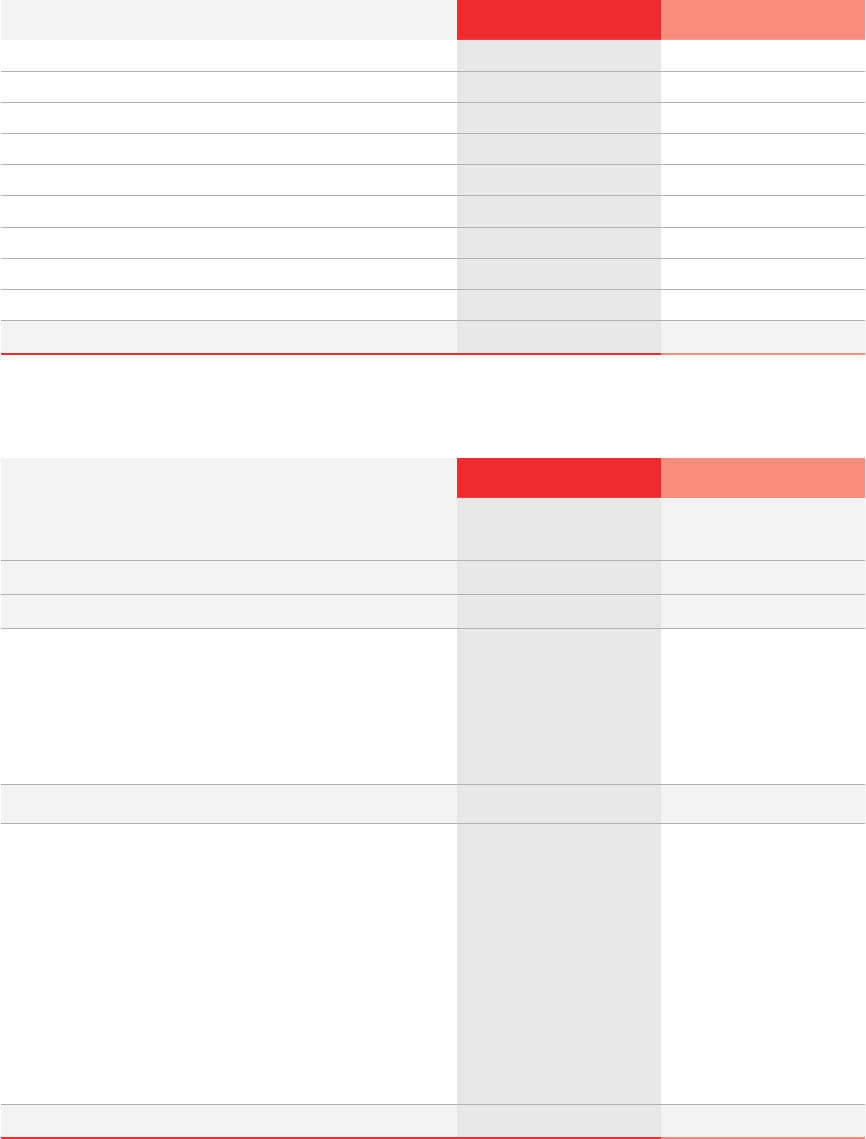

Net debt amounts to K€ 1,946,309 (previous year: K€ 1,948,833) as of December 31, 2020 and is calculated

as follows:

Dec. 31, 2020 Dec. 31, 2019 Change in 2020

Financial liabilities 2,357,116 2,526,255 -6.7 %

Cash and cash equivalents (410,807) (577,422) -28.9 %

Net debt 1,946,309 1,948,833 -0.1 %

15

Annual Report of Yeti GermanCo 1 GmbH 2020

The ratio of existing financial liabilities (K€ 2,357,116) to total assets (K€ 4,656,611) was 50.6 % in 2020

(previous year: 47.4 %).

The change in gross financial liabilities is shown below:

Statement of cash flows

The statement of cash flows is as follows:

The cash flow from operating activities was K€ 222,581 and therefore K€ 191,729 lower than the previous

year’s level. In addition to significantly higher income tax payments of K€ 283,160 (previous year: K€ 88,311),

this development is mainly due to changes in operating assets. The high income tax payments were incurred

in the US and result from the acquisition of Linde AG’s business there as of March 1, 2019.

The development in cash flow from investing activities was largely defined by investments in property,

plant and equipment and intangible assets of K€ 240,746 (previous year: K€ 249,420). The cash flow from

investing activities in the previous year reflected the acquisition of the business activities of Linde and Praxair

at K€ 2,501,285.

Gross financial liabilities as of Jan. 1, 2020 2,526,255

Cash changes:

New debt raised

Capitalized financing costs

Payments of principal

3,367

−

(40,401)

Non-cash changes:

Additions to lease liabilities

Changes due to currency translation

Change in Group reporting

Capitalized financing costs

24,447

(167,646)

−

11,094

Gross financial liabilities as of Dec. 31, 2020 2,357,116

Condensed version in K€

Jan. 1 - Dec. 31, 2020 Jan. 1 - Dec. 31, 2019

Profit before tax 69,400 (3,761)

Cash flow from operating activities 222,581 414,310

Cash flow from investing activities (217,990) (2,723,654)

Cash flow from financing activities (133,795) 2,888,751

Changes in cash and cash equivalents (129,204) 579,407

Cash and cash equivalents

at the beginning of the period 577,422 124

Currency translation effect on cash and cash equivalents (37,411) (2,109)

at the end of the period 410,807 577,422

16

Annual Report of Yeti GermanCo 1 GmbH 2020

The cash flow used in financing activities amounted to K€ 133,795, after cash generated by financing

activities of K€ 2,888,751 in the previous year. After financial liabilities were incurred to finance new

business activities in the previous year, these liabilities were paid off in installments in the past fiscal year.

There were cash outflows of K€ 91,185 (previous year: K€ 95,125) for interest essentially relating to

financing.

The cash funds of the Messer Industries Group amount to K€ 410,807 as of December 31, 2020.

Operating business will grow, investments will be made and the maturing loans and interest will be repaid

in fiscal 2021 as well. Medium-term planning is still focused on the consolidation of net debt for our

business activities in the US. The funds required will be generated from cash flow from operating activities,

available cash and unutilized credit facilities.

The Group has undertaken to invest in the acquisition, construction and maintenance of various production

facilities. Obligations of this kind relate to the future purchase of plant and equipment at market prices.

There are also long-term contracts giving rise to obligations. As of December 31, 2020, the commitments

under orders, investment projects and long-term contracts amounted to K€ 612,942 (previous year:

K€ 325,469).

Capital expenditure

Capital expenditure continues to focus on safeguarding existing business and exploiting profitable growth

potential. In line with business principles, we therefore primarily invest in projects that safeguard our

product supply or that offer opportunities for profitable growth. Furthermore, there is regular investment

in the modernization of production systems and distribution channels.

The capital expenditure of the Messer Industries Group as a whole is explained below.

The Messer Industries Group invested around € 247 million in intangible assets and property, plant and

equipment in 2020. Expressed as a percentage of total revenue, capital expenditure amounts to 12.6 %

(previous year: 14.8 %).

Capital expenditure breaks down by region as follows:

In North America, investment again focused on safeguarding existing business and projects dealing with

on-site plants and air separation units in the field of liquefied gases with opportunities for profitable growth.

Given the impact of the COVID-19 pandemic on the world economy, customers in North America postponed

projects and there were delays in the construction of new plants. Furthermore, North America postponed

several investment projects until the fourth quarter of the past fiscal year and the start of 2021.

Investments in intangible assets and property, plant and equipment essentially related to new air separation

units in Indianapolis, Indiana, USA, Claymont, Delaware, USA, and Arroyo, West Virginia, USA, the construction

Capital expenditure in K€

Jan. 1 - Dec. 31, 2020 Jan. 1 - Dec. 31, 2019

North America 179,460 179,190

Western Europe 51,704 52,501

South America 15,479 17,729

Total 246,643 249,420

17

Annual Report of Yeti GermanCo 1 GmbH 2020

of a carbon dioxide plant in Keyes, California, USA, and the modernization and repair of an LCO

2

plant in

Bayport, Texas, USA. Furthermore, there was investment in sales equipment and maintenance, in addition to

capital expenditure to boost productivity.

Large-scale plant projects account for € 23.1 million of capital expenditure in Western Europe (€ 51.7 million),

and operating activities for € 28.6 million. The biggest projects were the air separation unit in Speyer (€ 12.4

million) that went live at the end of 2020 and the new air separation unit Messer V in Spain, which is due to

go live at the end of 2021. Investments in operating activities mainly relate to the maintenance of machinery,

support for core business and investments in cylinders.

In South America, as in the previous year, capital expenditure amounted to € 15 million and related to

operating activities and the maintenance of existing systems.

Net assets

Total assets declined by K€ 678,115 in the reporting year to K€ 4,656,611 as of December 31, 2020. The

main factors contributing to this were the decline in non-current assets of K€ 457,051 and in cash and cash

equivalents of K€ 166,615.

At 79.9 %, non-current assets again account for the largest share of total assets (previous year: 78.3 %).

As before, the largest item on the assets side is capital assets (property, plant and equipment, right-of-use

assets and intangible assets) at 78.8 %, down by 11.1 % as against the previous year (77.3 %). This change

mainly results from depreciation and amortization and from investing activities in the current fiscal year.

The equity ratio (including non-controlling interests) increased slightly to 25.9 % (previous year: 24.6 %).

Net financial liabilities amount to K€ 2,357,116 in the fiscal year (previous year: K€ 2,526,255) and account for

50.6 % (previous year: 47.4 %) of total equity and liabilities. Please refer to our comments under “Financial

position”.

Operating assets

Net working capital breaks down as follows:

The increase in operating assets of K€ 21,791 is essentially due to the trade payables of our companies

in the US and Brazil.

Operating assets

Dec. 31, 2020 Dec. 31, 2019

Inventories 156,361 184,521

Trade receivables 256,792 276,407

Trade payables (148,045) (215,231)

Prepayments received (16,203) (18,583)

248,905 227,114

18

Annual Report of Yeti GermanCo 1 GmbH 2020

The ratio of inventories (less prepayments received) and trade receivables to trade payables is around

3:1 (previous year: 2:1). The ratio of operating assets to revenue is 12.7 % (previous year: 13.5 %).

Days sales outstanding (DSO) improved to 47 (previous year: 59).

Overall statement on the economic situation

The satisfactory overall business development is in line with expectations that were formed when acquiring

the new business activities. The Messer Industries Group has a global presence with its three main regions

of Western Europe, North America and South America, and it has good regional diversification in a large

number of countries within these three core regions. Weak demand on individual markets or downturns in

specific industries can therefore often be compensated.

Forecast Report

General economic development

The global progress in COVID-19 vaccine development in recent months has given the leading economic

research institution grounds for optimism in their assessment of the global GDP growth trend for 2021. On

top of this, there is the stimulus of fiscal policy measures and economic relief programs recently resolved

and set up by leading economic nations such as the US, Japan and the EU. For 2021 and 2022 as well,

tangible catch-up effects are expected in the global growth trend for GDP, which should exceed the average

level of recent years. For example, the World Bank

1

or the International Monetary Fund (IMF)

2

are forecas-

ting global GDP growth for 2021 of 4.0 % to 5.5 % following a projected -4.3 % to -3.5 % in 2020. The return

of global economic momentum is expected to be driven by significantly stronger GDP growth in the

industrialized nations and the emerging markets alike, though the GDP growth rates of the industrialized

nations obviously will not match those of the emerging markets. For 2021, the IMF, for example, is forecas-

ting total GDP growth of 4.3 % for the developed nations after an expected -4.9 % in 2020, but GDP growth

of 6.3 % for the emerging markets after -2.4 % in 2020.

China is expected to take advantage of its early recovery in 2020 to further advance its claim to global

economic significance. For 2021, the World Bank and the IMF are forecasting a rise in GDP growth momen-

tum to up to 8.3 %, as compared to a previously waning economic trend of around 6 % in 2019. The risk that

the trade conflict with the US will escalate is seen as less relevant following the change of government. In

the US, ongoing GDP growth is expected to benefit from fiscal policy measures, the decline in political

uncertainty and comprehensive COVID-19 vaccination measures. Thus, the economic research institutes

1,2

are forecasting a significantly higher GDP growth rate of up to 5.1 % in 2021 after a decline in GDP of more

than 3 % in 2020. According to World Bank forecasts, consistently good financing conditions and the progress

in COVID-19 vaccinations should lead to a moderate resurgence of economic growth in Brazil with a GDP

growth rate of 3.0 % in 2021.

The World Bank and the IMF have highlighted the significant forecast risks in their statements for 2021, this

time primarily on account of the uncertainty regarding the outcome of efforts to combat the COVID-19

pandemic.

1

Global Economic Prospects, January 2021

2

World Economic Outlook, Update January 2021

19

Annual Report of Yeti GermanCo 1 GmbH 2020

Outlook for the Messer Industries Group

The medium-term planning of the Messer Industries Group is still defined by efforts to boost profitability

while at the same time achieving a modest reduction in net debt. Through suitable investment, we intend

to further increase revenue in line with the general economic conditions and utilize selected measures to

stabilize or increase the Messer Industries Group’s profitability.

In Western Europe – provided that there are no major unforeseen consequences due to an ongoing

COVID-19 pandemic – revenue is expected to grow by 2.4 % (previous year: 5.0 %) and EBITDA by 9 %

(previous year: 7 %) in the coming fiscal year. Regarding future economic developments in Europe, we

anticipate an end to partial business closures in connection with efforts to curb the COVID-19 pandemic the

first quarter of 2021. Our business activities in Europe will continue to focus on optimized utilization of the

new production capacity created in recent years, selected customer projects and targeted capacity

expansion. In Europe especially, we anticipate further price increases in the area of energy costs, which are

highly significant to our industry.

The outlook for North America anticipates an increase in revenue of 1 % (previous year: 5 %) with EBITDA

remaining unchanged (previous year: increase of 6 %) in fiscal 2021. The reversal of unsustainable cost

management activities and the volume recovery in core industrial segments will allow EBITDA and EBITDA

margins to return to a normal level, i.e. lower level.

Assuming that industrial activities throughout the region will continue to grow, revenue in South America

is expected to rise by 7 % (previous year: 4 %) with EBITDA expanding by 5 % (previous year: 5 %). Local

currencies are not expected to depreciate further.

Future investment decisions are made in line with a proportionate development of net debt.

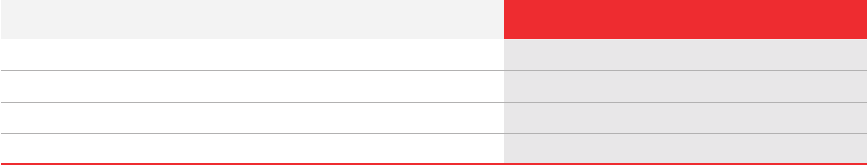

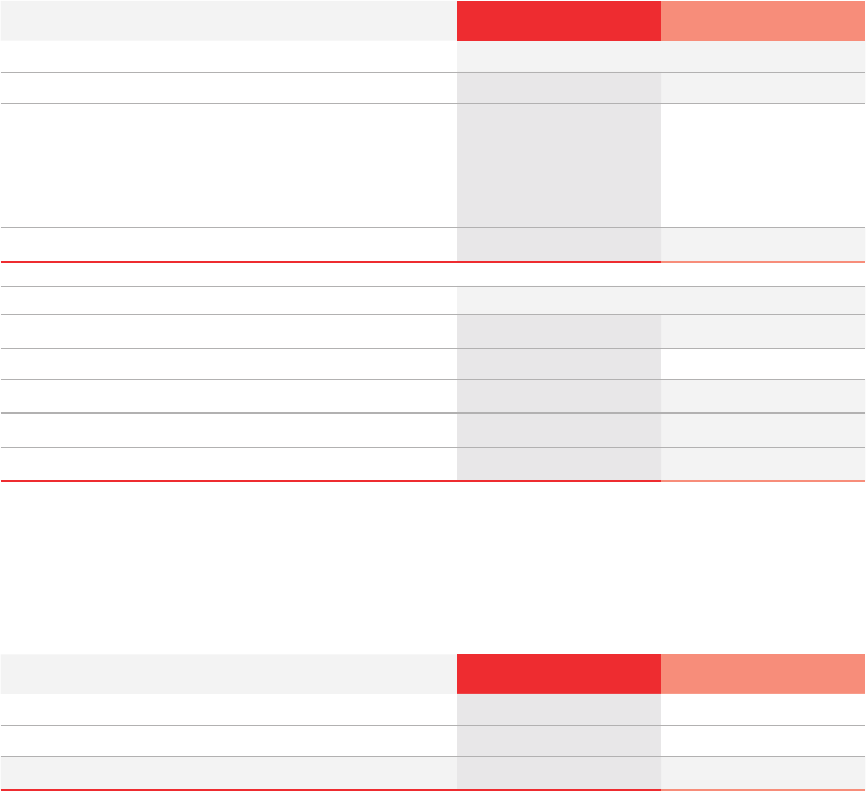

The developments of the most important financial performance indicators of the Messer Industries Group

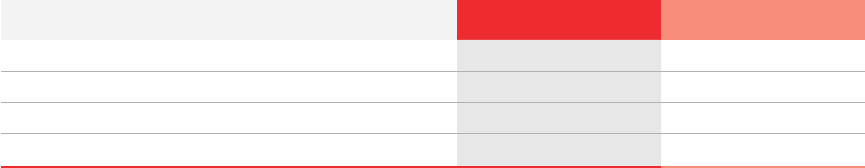

for the following year are planned as follows:

Planning for fiscal 2021 is based on the assumptions of successful efforts to combat the COVID-19 pandemic

and an end to partial business closures.

We expect that growth momentum in North America will continue to accelerate in 2021 after recovering

from the COVID-19 pandemic. In our overall forecast for Western Europe, we have assumed a comparatively

slow recovery in economic growth and industrial production.

In South America, we are forecasting a slight increase in market growth with industrial production continuing

to rise.

2021 vs. 2020

Revenue Slight increase

EBITDA Slight increase

Capital expenditure Strong increase

Net debt Slight decrease

20

Annual Report of Yeti GermanCo 1 GmbH 2020

Forward-looking statements

The forecast contains forward-looking statements based on management’s current appraisal of future

developments. These statements should not be interpreted as a guarantee that these expectations will

actually occur. The future business performance and earnings of the Messer Industries Group are depen-

dent on a number of risks and uncertainties, and can therefore diverge significantly from the forward-look-

ing statements made here.

Report on Opportunities

As an international supplier of industrial gases, opportunities arise for the Messer Industries Group from

the versatile applications for industrial gases in the manufacture of products needed in all fields of life and

every country of the world. Through our investments, we seize the corresponding opportunities to tap new

business potential and to maintain and expand our market position.

Specifically, the following opportunities in particular could be significant to business development and to

financial position and financial performance:

General economic opportunities

The overall economic environment generally influences our business activities, our financial position and

financial performance and our cash flows. Our forecast for 2021 is based on the expectation that the future

economic framework will be consistent with the information presented in the forecast section of this

management report. If the global economy as a whole or in regions / countries relevant to our business

develop better than shown in this forecast, our revenue and earnings could outperform the forecast.

In the Americas in particular, industrial gases business proved highly resistant during the COVID-19 pandemic.

We therefore assume that future business developments will not follow the modest economic growth / GDO

recovery forecasts.

Opportunities arising from industrial gas applications

Our products are used in a variety of production processes worldwide. In the field of application technology,

the Messer Industries Group continuously analyzes various processes to enhance production efficiency for

our customers through the use of industrial gases. New applications identified in this way could open up

corresponding business potential with a positive impact on revenue and earnings.

21

Annual Report of Yeti GermanCo 1 GmbH 2020

Opportunities arising from optimization

Where necessary, the Messer Industries Group implements selected optimization measures in support of

business performance. If the various measures are implemented more quickly or more successfully, this

could have a positive impact on revenue and earnings.

Opportunities through our employees

The Messer Industries Group promotes “ideas management” throughout the organization, allowing our

employees to suggests improvements across all national borders. In addition, the active development and

use of our employees’ potential is supported by systematic personnel development programs and training.

We believe that investing in the development of our employees promotes a good corporate culture

throughout the company and could have a positive effect on revenue and earnings.

Risk Report

As an international supplier of industrial gases, we face risks with that are inextricably linked to entrepre-

neurial activity. In addition to fluctuating demand for industrial gases and the related products, future

earnings development is also dependent on economic trends in individual countries that are beyond the

Messer Industries Group’s control.

The following risks have been presented in gross terms, i.e. mitigating factors have not been taken into

account.

Specifically, the following risks in particular could have a significant negative impact on business develop-

ment and on financial position and financial performance:

General economic risks

The industrial gases business is competitive. The effect of globalization on the company can vary according

to geographical location. Any change in the competitive environment could reduce Messer’s future earnings

and cash flows. The Messer Industries Group operates in a large number of countries, and it is therefore

exposed to local political, social and economic conditions and the resulting risks.

22

Annual Report of Yeti GermanCo 1 GmbH 2020

Market risks

We deliver to a broad range of industries and sectors (including steel production and metal processing, the

chemicals industry, petrochemicals industry, food and beverage industry, healthcare and glass industry) on

the basis of long-term supply agreements running from between up to 15 years in Europe to up to 20 years

in the Americas. A significant reduction in market demand in any one of these key industries or sectors

could adversely affect future earnings. We currently rate operational risks as medium.

Health risks

We supply a wide range of industries that today run production operations virtually everywhere in the world.

These global supply chains can be severely disrupted by epidemics of infectious diseases in major manufac-

turing countries or a pandemic. In view of the global COVID-19 pandemic, we currently rate the correspon-

ding risk of an economic impairment as high. With regard to health systems already in place in large parts of

the world and the very recent developments in vaccine distribution, we assign the longer-term economic

risks of disruption stemming from this to the medium-risk category.

Cost risks

Regulatory or governmental changes or intervention in the energy sector can lead to rising energy prices

in individual countries. Rising energy requirements are causing fluctuations in prices for oil and energy with

corresponding implications for the operating materials and precursors required by the Messer Industries

Group.

In the US, management is implementing measures to contain these commodity risks, including the electrici-

ty price risk arising from electricity purchases for operating activities. Management’s objectives and strategies

consist of hedging against these risks as far as possible and reasonable. It is also assumed that energy

prices will decrease in the years ahead due to declining demand for natural gas and low oil prices.

Purchase prices for individual significant products fluctuate considerably. Although the Messer Industries

Group can often pass cost increases on to its customers through price escalation clauses in its supply

agreements (especially increases in the price of electricity) or mitigate them with long-term procurement

contracts, price increases for energy and external procurement costs can reduce the profitability of the

Messer Industries Group. We currently rate cost risks as high.

Price risks

In individual countries, the highly competitive environment could lead to disproportionate price trends

that reduce our future revenue and earnings. We currently rate price risks as medium to high.

Operational risks

A business interruption at our production facilities can lead to supply disruption for our customers. We

endeavor to avoid this situation by regularly maintaining and monitoring our equipment. In the event of

damage, we have emergency and contingency plans in addition to tools to mitigate the financial conse-

23

Annual Report of Yeti GermanCo 1 GmbH 2020

quences of a business interruption for our customers. The Messer Industries Group is working to improve

delivery reliability and flexibility to safeguard delivery capability for customers even in the event of an

emergency. The range and quality of our services are dependent on the availability of purchased hardware

and the production equipment used (e.g. cylinders and tanks), and on the service quality of suppliers and

business partners. We currently rate operational risks as medium to high.

IT risks

The use of state-of-the-art information technology plays a key part in handling and securing business

processes within the Messer Industries Group.

The security and compliance of the information systems are set out in the IT strategy objectives. On this

basis, we are constantly designing, implementing and reviewing measures to protect data, applications,

systems and networks. This process takes both preventive and corrective measures into account.

We use preventive vulnerability scans to check the externally accessible IT communication points of our

European companies. The vulnerabilities identified are addressed according to their risk category and

resolved with corresponding measures.

We use a checklist jointly defined by the IT security team to perform self-audits of IT security, thereby

mapping the current status, and recommend measures to avoid or reduce risks. The analysis focuses on

questions about the IT systems and applications used, and also examines infrastructure or network areas.

This instrument also serves to raise awareness and avoid potential risks in IT operations. We currently rate

IT risks as medium.

Financial risks

We require our available cash funds and credit facilities for our growth and investments. We are dependent

on a stable and, in particular, liquid financial sector. The Messer Industries Group relies on cash from current

business activities to settle the obligations under its borrowing operations, including compliance with

covenants. This depends to a large extent on a positive operating cash flow.

The Group has recognized goodwill. Applying IAS 36, i.e. testing for impairment, can lead to impairment

losses on goodwill if the market and business prospects of a subsidiary, associate or a cash-generating unit

deteriorate significantly compared to their original measurement date. In the event of impairment becoming

necessary, this could have a significant impact on earnings and accounting ratios.

Global economic collapse or downturns are a recurrent threat in conjunction with financial or debt crises.

The Messer Industries Group will closely monitor current developments in order to take countermeasures,

if necessary, in the form of cost and investment saving programs. The possible deterioration in the credit

ratings of our customers entails the risk of bad debts and delays to joint projects.

In the Messer Industries Group, financial risks can also arise from changes in exchange rates and interest

rates. The management of interest rate, currency and liquidity risks is handled by the Treasury department

based on the guidelines set out by management. The Treasury department calculates and measures financial

risks and hedges against them. The Messer Industries Group currently uses standard currency forwards,

non-deliverable forwards, interest derivatives and electricity swaps as hedging instruments. The Treasury

guidelines contain principles for general risk management and individual regulations for specific areas, such

24

Annual Report of Yeti GermanCo 1 GmbH 2020

as currency and interest rate risks, the use of derivative financial instruments and the investment of surplus

cash. The risks are monitored at all times and the extent of protection is adjusted if necessary. We currently

rate the impact of relevant financial risks as low to medium.

Currency risks

As far as operating activities of the Messer Industries Group are concerned, the individual Group companies

predominantly conduct their business locally in their functional currency. The overall currency risk from

transaction risks is thus considered low overall.

However, a number of Group companies are exposed to foreign currency risks in connection with operational

transactions not denominated in their own functional currency. This mainly relates to payments for product

or service imports and are hedged as far as possible. Like all market participants, we could unexpectedly

encounter appreciation in a functional currency that weakens the country’s international competitive

capability for exports and our local activities. We see currency risks from translating foreign currency

exposures into euro as a standard part of doing business. Exchange rate losses against the euro could lead

to lower consolidated net profit and consolidated equity. We rate currency risks as high at this time.

Legal and contractual risks

Time and again, businesses are confronted with allegations that they have infringed industrial rights or legal

obligations, delivered defective products or failed to comply with environmental protection laws. Regardless

of their chances of success, such claims can result in very high defense costs. The Messer Industries Group

relies on the support of both in-house and external experts to handle such matters.

The Group has recognized a provision of € 5 million in connection with investigations in Spain. For further

information on these investigations, please refer to note 31 “Contingent liabilities” in the notes to the

consolidated financial statements.

Our business activities in many countries are subject to specific environmental laws and regulations, for

example on air emissions, groundwater pollution, the use and handling of dangerous substances and soil

analysis and detoxification. This can give rise to liability risks in conjunction with either past or current

operations. New environmental requirements in particular necessitate the occasional adjustment of our

standards. This could result in higher production costs and modifications to the production process. Howe-

ver, the recent past shows that the integration of stricter environmental regulations results in a more

efficient production process and higher quality product. We currently rate legal and contractual risks as

medium.

Overall conclusion

The opportunities set out above show that there is both internal and external potential. We endeavor to

actively develop in-house potential and will leverage external potential whenever the opportunity arises.

These are not the only risks to which the Messer Industries Group is exposed. Some risks, which have not

yet been identified or which are not considered significant today, could possibly have an adverse effect on

the Messer Industries Group if the overall conditions were to change. However, no risks were identified in

25

Annual Report of Yeti GermanCo 1 GmbH 2020

The principles of risk policy are defined by management. Risk management is designed to ensure that the

Group remains a going concern and to increase its enterprise value; it is therefore a key component of all

decision-making and business processes. The management structure and the reporting processes in place

ensure that not just the developments that could threaten the Group as a going concern, but also even

developments that could pose a threat to short-term corporate targets (such as EBITDA), are reported to the

appropriate persons promptly and regularly. This allows management to initiate measures to mitigate any

operating or financial risks early on. Risk managers who safeguard the local reporting processes have been

appointed at the individual subsidiaries.

The Messer Industries Group has arranged for adequate insurance for potential losses and liability risks,

which ensures that the possible financial consequences of risks that occur are either contained or eliminated

entirely. The extent of this insurance cover is continuously optimized based on the specific requirements of

the companies in each country.

The Safety, Health, Environment, Quality (SHEQ) department will continue to carry out audits and risk

analyses in order to further reduce the accident ratio.

State-of-the-art technologies are used in IT to minimize risks in this area. Unauthorized access to data and

systems, as well as significant data losses, have therefore been ruled out as far as possible. The efficiency,

availability and reliability of systems are constantly being monitored and improved. The security concept

also comprises detailed contingency planning. All the technologies used are regularly tested to ensure the

security of IT-based business processes so as to minimize risks of all kinds.

Tax laws and competition regulations can also give rise to business risks. The company relies on the advice

of both in-house and external experts.

Messer’s Corporate Governance contains a large number of requirements and measures to prevent risks

from occurring. The primary component of risk management at the Messer Industries Group is a risk

assessment. This is performed – and updated each year – by the central offices for the respective department

and by each consolidated subsidiary for its own business. The reports on this are channeled centrally to the

Corporate Compliance Officer (CCO) in the Americas and Western Europe. The Compliance department for

Western Europe is run by Messer Group GmbH. Training is organized and carried out based on this to cover

the identified risk areas and to identify best practices for minimizing the occurrence of risks. Messer has

issued binding compliance guidelines for its companies. In particular, these include the Code of Conduct and

the Group Guidelines. All managers at the first and second management levels have confirmed that they

have received these regulations, acknowledged their content and are committed to complying with them.

Risk Management

2020 that, individually or in aggregate, could significantly influence the Messer Industries Group as a going

concern. Management does not expect these risks to occur in 2021 either. The main operational risks in the

reporting period are still in the areas of market development and production. We have put all organizational

requirements in place to identify potential risks early on. Our vigilant, active risk management system, as

described below, helps us to limit risk.

26

Annual Report of Yeti GermanCo 1 GmbH 2020

Furthermore, all employees have been informed of the content relevant to them and have confirmed their

compliance. Management and employees receive regular information and training on the content of these

guidelines, other policies and rules of conduct.

On the basis of a matrix structure, Compliance works closely with the SHEQ, Medical, IT, Internal Audit,

Legal and Insurance departments. Compliance breaches are followed up and dealt with appropriately. They

are also taken as an opportunity to consider preventive measures to stop the associated risk from occurring

again in the future if possible.

Bad Soden am Taunus, April 9, 2021

Yeti GermanCo 1 GmbH

27

Annual Report of Yeti GermanCo 1 GmbH 2020

28

Annual Report of Yeti GermanCo 1 GmbH 2020

Consolidated Financial Statements

of Yeti GermanCo 1 GmbH 2020

Consolidated Income Statement

of Yeti GermanCo 1 GmbH, Sulzbach (Taunus), for the period from January 1 to December 31, 2020 (in K€)

Note

Jan. 1 - Dec. 31,

2020

Jan. 1 - Dec. 31,

2019

Revenue 4 1,965,492 1,687,608

Cost of sales 5 (1,001,068) (871,564)

Gross profit 964,424 816,044

Selling and distribution expenses 6 (588,614) (542,604)

Reversal of impairment / (impairment) on trade receivables 32 (2,861) (4,026)

General and administrative expenses 7 (181,113) (169,558)

Other operating income 8 27,310 28,637

Other operating expenses 9 (24,164) (48,278)

Operating income 194,982 80,215

Income from investments accounted for using the equity method 10, 16 58 326

Other investment result, net 10 (968) (668)

Finance income 10 11,369 31,699

Finance costs 10 (136,041) (115,333)

Financial result, net (125,582) (83,976)

Profit before tax 69,400 (3,761)

Income / (expense) from income taxes 11 (16,939) 6,970

Profit after tax 52,461 3,209

Consolidated net profit 52,461 3,209

Attributable to:

Shareholders of the parent company 51,737 2,695

Non-controlling interests 724 514

29

Annual Report of Yeti GermanCo 1 GmbH 2020

Consolidated Statement of Comprehensive Income

of Yeti GermanCo 1 GmbH, Sulzbach (Taunus), for the period from January 1 to December 31, 2020 (in K€)

For further information on equity, please refer to the comments on the consolidated statement of changes in equity below and note

30 “Equity” in the notes to the consolidated financial statements.

Note

Jan. 1 - Dec. 31,

2020

Jan. 1 - Dec. 31,

2019

Consolidated net profit 52,461 3,209

Items that may be reclassified to profit or loss

Change in translation adjustments relating to foreign subsidiaries 30 (154,152) (26,766)

Of which:

Reclassifications of currency translation differences in conjunction with

deconsolidation

− –

Result from the net investment in a foreign operation 30 4,700 6,708

Deferred taxes 11 (1,038) (1,683)

Derivative financial instruments

Change in fair value of derivatives used for hedging purposes

1

32 (14,113) (13,863)

Reclassification to profit or loss 32 9,948 4,496

Deferred taxes 11 (569) 2,781

From associates accounted for using the equity method 16 – –

(155,224) (28,327)

Items that will not be reclassified to profit or loss

Remeasurement of net defined benefit obligation for pension plans

and other employee benefits

Change in remeasurement of the net defined obligation for pension plans 25 (3,507) (7,735)

Deferred taxes 11 605 2,138

(2,902) (5,597)

Other comprehensive income (158,126) (33,924)

Total comprehensive income (105,665) (30,715)

Attributable to:

Shareholders of the parent company (105,815) (31,258)

Non-controlling interests 150 543

1

Gains / losses on financial instruments in effective hedges

30

Annual Report of Yeti GermanCo 1 GmbH 2020

Consolidated Statement of Financial Position

of Yeti GermanCo 1 GmbH, Sulzbach (Taunus) as of December 31, 2020 (in K€)

Assets

Note Dec. 31, 2020 Dec. 31, 2019

Goodwill 14 566,429 655,901

Right-of-use assets 14 78,814 84,182

Other intangible assets 14 1,005,648 1,162,332

Property, plant and equipment 15 2,017,836 2,223,363

Investments accounted for using the equity method 16 5,680 5,894

Equity investments and other financial investments 17, 18 1,494 1,494

Deferred tax assets 11 16,909 6,323

Other financial assets 19 25,375 37,364

Non-financial assets 19 1,959 1,357

Non-current assets 3,720,144 4,178,210

Inventories 20 156,361 184,521

Trade receivables 21 256,792 276,407

Current income tax assets 45,285 20,926

Other current financial assets 23 24,434 42,319

Non-financial assets 23 42,788 54,921

Cash and cash equivalents 24 410,807 577,422

Current assets 936,467 1,156,516

Total assets 4,656,611 5,334,726

31

Annual Report of Yeti GermanCo 1 GmbH 2020

Consolidated Statement of Financial Position

of Yeti GermanCo 1 GmbH, Sulzbach (Taunus) as of December 31, 2020 (in K€)

Equity and Liabilities

Note Dec. 31, 2020 Dec. 31, 2019

Issued capital 30 30 30

Capital reserves 30 1,329,973 1,329,973

Retained earnings 30 53,133 4,298

Other components of equity 30 (183,007) (28,357)

Equity attributable to shareholders of the parent company 1,200,129 1,305,944

Non-controlling interests 30 3,648 4,195

Equity 1,203,777 1,310,139

Provisions for employee benefits 25 47,162 49,708

Other provisions 26 60,932 51,067

Non-current financial liabilities 27 2,333,741 2,502,734

Deferred tax liabilities 11 466,019 529,505

Other non-current financial liabilities 28 2,052 −

Non-current liabilities 2,909,906 3,133,014

Other provisions 26 26,532 26,859

Current financial liabilities 27 23,375 23,521

Trade payables 32 148,045 215,231

Current income tax liabilities 29 27,022 283,166

Other current financial liabilities 29 83,099 33,176

Non-financial liabilities 29 234,855 309,620

Current liabilities 542,928 891,573

Total equity and liabilities 4,656,611 5,334,726

32

Annual Report of Yeti GermanCo 1 GmbH 2020

Consolidated Statement of Changes in Equity

of Yeti GermanCo 1 GmbH, Sulzbach (Taunus), for fiscal 2020 (in K€)

For further information on equity, please refer to the comments under note 30 “Equity” in the notes to the consolidated financial

statements.

Issued

capital

Reserves Other components of equity

Equity

attributable to

shareholders

of the parent

company

Non-con-

trolling

interests

Total equity

Capital

reserves

Retained

earnings

Currency

translation reserve

Hedging reserve

Result from

net invest-

ment

As of Jan. 1, 2019

25 75 7,200 (1)

– –

7,299 12 7,311

Consolidated net

profit

– –

2,695

– – –

2,695 514 3,209

Other comprehen-

sive income

– –

(5,597) (26,795) (6,586) 5,025 (33,953) 29 (33,924)

Total comprehen-

sive income

– –

(2,902) (26,795) (6,586) 5,025 (31,258) 543 (30,715)

Additions to/

withdrawals from

reserves

– – – – – – – – –

Distributions

– – – – – – – – –

Capital increase

5 1,329,898

– – – –

1,329,903

–

1,329,903

Capital reduction

– – – – – – – –

—

Additions/disposals

of non-controlling

interests

– – – – – – –

3,640 3,640

As of Dec. 31, 2019

30 1,329,973 4,298 (26,796) (6,586) 5,025 1,305,944 4,195 1,310,139

As of Jan. 1, 2020

30 1,329,973 4,298 (26,796) (6,586) 5,025 1,305,944 4,195 1,310,139

Consolidated net

profit

– –

51,737

– – –

51,737 724 52,461

Other comprehen-

sive income

– –

(2,902) (153,578) (4,734) 3,662 (157,552) (574) (158,126)

Total comprehen-

sive income

— — 48,835 (153,578) (4,734) 3,662 (105,815) 150 (105,665)

Additions to/

withdrawals from

reserves

– – – – – – –

(1) (1)

Distributions

– – – – – – –

(696) (696)

Capital increase

– – – – – – – – –

Capital reduction

– – – – – – – – –

Additions/disposals

of non-controlling

interests

– – – – – – – – –

As of Dec. 31, 2020

30 1,329,973 53,133 (180,374) (11,320) 8,687 1,200,129 3,648 1,203,777

33

Annual Report of Yeti GermanCo 1 GmbH 2020

Consolidated Statement of Cash Flows

of Yeti GermanCo 1 GmbH, Sulzbach (Taunus), for fiscal 2020 (in K€)

Note

Jan. 1 - Dec. 31,

2020

Jan. 1 - Dec. 31,

2019

Consolidated net profit before taxes 69,400 (3,761)

Income taxes paid (283,160) (88,311)

Depreciation of property, plant and equipment, amortization of

intangible assets and impairment

14, 15 346,058 292,604

Losses / (gains) on disposal of fixed assets (7,352) (2,516)

Changes in investments in associates 16 (58) (326)

Net interest income 10 85,816 83,796

Changes in inventories 13,191 23,793

Changes in trade receivables (6,574) 33,030

Changes in provisions (430) 9,986

Changes in trade payables (14,891) 46,221

Changes in other liabilities and other assets 20,581 19,794

Cash flow from operating activities 222,581 414,310

Investments in property, plant and equipment and intangible assets (240,746) (249,420)

Investments in equity investments and other non-current assets – (2,501,285)