Published on 13

th

Aug 2024

Terms & Conditions – HDFC Bank Millennia Credit Card

CashBack Proposition

Definition: For the Millennia Credit Card, the following terms, unless the context otherwise admits, shall have

the following meanings:

• CashBack shall mean the CashPoints awarded in the customer’s credit card account under the reward

points scheme.

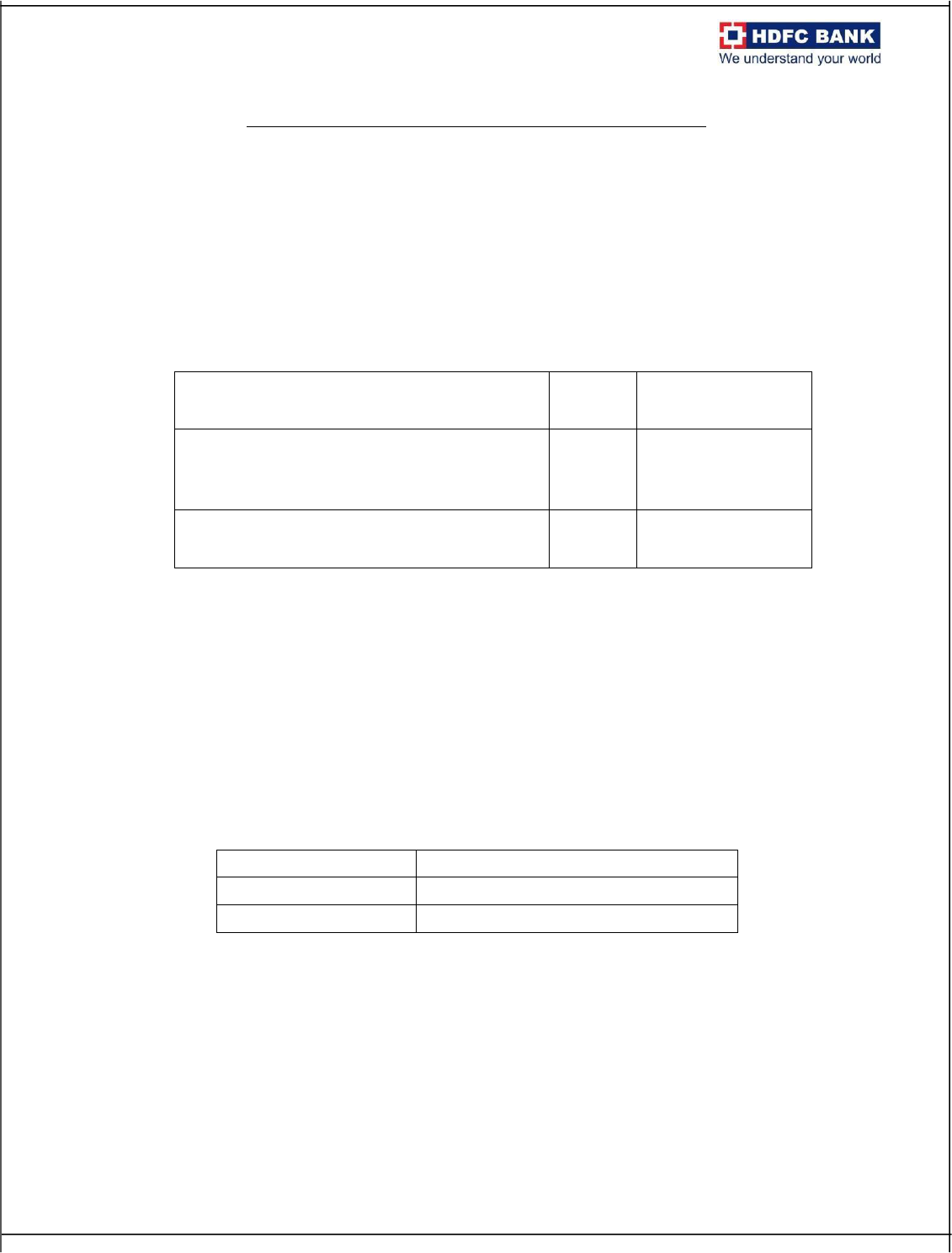

• The CashBack will be processed as per the following table:

Spends on

CashBack

Maximum CashBack /

CashPoints per Cycle

CashBack on Amazon, BookMyShow, Cult.fit,

Flipkart, Myntra, Sony LIV, Swiggy, Tata CLiQ, Uber &

Zomato*

5%

1000

Other Spends** (except Fuel, EMI, Wallet, Rent

payments, Govt related txns)

1%

1000

* CashBack valid only for non-emi spends in the 10 online merchants.

** Gift or Prepaid Card loads & Voucher Purchase transactions will be considered in other spends

category.

Note:

• Effective 1st December 2023, complimentary lounge access on domestic airports will no longer be

available on Millennia Credit Card

• Effective 1

st

September 2024, Education payments made through third-party apps will NOT earn

Reward Points. However, education payments made directly through college/school websites or their

POS machines will earn Reward Points

• Effective 1

st

September 2024, Wallet loading and EMI transactions will NOT earn Reward Points.

Category

Merchant Category Codes (MCC)

Education

8211,8220,8241,8244,8249,8299

Wallet

6540

Note :

Cardholder can redeem CashPoints as CashBack against their outstanding on the Millennia Credit Card.The

CashPoints will be posted on calendar month basis, the transaction settled in the system between 1st to

30/31st of the calendar month will be posted in the 1st week of the subsequent calendar month.

Published on 13

th

Aug 2024

5% CashBack on 10 Online Merchants – Terms & Conditions

• 10 online merchants qualifying for 5% CashBack are Amazon, BookMyShow, Cult.fit, Flipkart, Myntra,

Sony LIV, Swiggy, Tata CLiQ, Uber & Zomato

• CashPoints are an exclusive Rewards metric system created for our Credit Cardholders. CashPoints can

be utilized towards CashBack redemption against the statement at the rate of 1 CashPoint = ₹1 for

Millennia Credit Card Holders.

• The CashPoints will be posted on calendar month basis, the transaction settled in the system between

1

st

to 30/31

st

of the calendar month will be posted in the 1

st

week of the subsequent calendar month.

• The transaction settled from the merchant will be eligible for Cashpoints and settlement/Posting date

of the transaction will be considered for points calculation.

• The Cardholder can earn up to 1,000 CashPoints under the 5% CashBack on 10 online merchants in a

calendar month.

• CashBack of 5% on 10 merchants are calculated basis the Terminal / merchant IDs (TIDs & MIDs) shared

by the respective merchant partners. If in case the TID / MID is not available in the set-up, such

transactions will not qualify for the benefit.

• CashPoints earned will be computed based on spends during the calendar month period minus any

returns or refunds during the same period.

• Incase the purchase/transaction is returned/cancelled/reversed post calendar month completion.

Then the equivalent CashPoints will be reversed/adjusted under the 5% CashPoints category.

• CashPoints shall not be eligible for the following spends on the card, o Fuel Spends o Rent payments

and Govt Related transactions o Cash Advances o Payment of Outstanding Balances o Payment of card

fees and other charges o Smart EMI / Dial an EMI transaction

• Spends beyond the capping of 1,000 shall not be considered for CashPoints posting.

• A cardholder will be eligible for 1% CashPoints as per product feature if he/she does a transaction

through SmartBuy/PayZapp which includes transaction from 10 online merchants also. All other

existing SmartBuy/PayZapp offers will be applicable as per SmartBuy/PayZapp Terms & Conditions.

• A cardholder will be eligible for 1% CashPoints on prepaid card/gift Card/ wallet load and / or voucher

purchases. All the transactions carried out through the Merchant Category Code (MCC) of 6540 (as

defined by card networks Visa, MasterCard, RuPay and Diners) will be considered under 1% CashPoints

even if it is from the 10 online merchants.

• The 5% CashPoints on Uber is eligible for travel/commute related spends. The Uber transactions carried

out through the MCC code of 4121 (as defined by card networks Visa, MasterCard, RuPay and Diners)

will only be considered for 5% CashPoints.

Published on 13

th

Aug 2024

1% CashBack on other spends – Terms & Conditions

• 1% cashback on all other spends excluding Fuel, Wallet, EMI, govt, rental transactions.

• CashPoints are an exclusive Rewards metric system created for our Credit Cardholders. CashPoints can

be utilized towards CashBack redemption against the statement at the rate of 1 CashPoint = ₹1 for

Millennia Credit Card Holders.

• The CashPoints will be posted on calendar month basis, the transaction settled in the system between

1

st

to 30/31

st

of the calendar month will be posted in the subsequent month 1

st

week.

• The transaction settled from the merchant will be eligible for Cashpoints and settlement/Posting date

of the transaction will be considered for points calculation.

• Spends beyond the capping of 1,000 shall not be considered for CashPoints posting.

• CashPoints shall not be eligible for the following spends/transactions on the card, o Fuel Spends o Rent

payments and Govt Related transactions o Cash Advances o Payment of Outstanding Balances o

Payment of card fees and other charges o Smart EMI / Dial an EMI transaction

• The Cardholder can earn up to 1,000 CashPoints under the 1% CashBack on other spends in a calendar

month.

• CashPoints earned will be computed based on spends during the calendar month period minus any

returns or refunds during the same period.

• In case the purchase/transaction is returned/cancelled/reversed post calendar month completion.

Then the CashPoints will be reversed from next month earning under the 1% CashPoints category.

• A cardholder will be eligible for 1% CashPoints on prepaid card/gift Card/ wallet load and / or voucher

purchases. All the transactions carried out through the Merchant Category Code (MCC) of 6540 (as

defined by card networks Visa, MasterCard, RuPay and Diners)

• Smartpay transactions will be considered under 1% CashBack category.

• With effect from 1st January 2023, Rent payments and Government related transactions will NOT earn

Reward Points.

Milestone Benefit – Terms & Conditions

• Cardholder will be eligible if he/she achieves the spends target of ₹1 lac within the specified calendar

quarter.

• The calendar quarter are January to March, April to June, July to September, October to December.

• The transaction settled from the merchant within the calendar quarter will be eligible for considering the

target achievement and settlement/Posting date of the transaction

• EMI Principal amount paid during the calendar quarter only will be considered under spend target

achievement.

• SmartEMI/Dial An EMI (DAE) amount will not considered under this Milestone benefit achievement.

• Cardholder can view the spends achievement via Net Banking. Please follow the path to check: Net banking

login -> cards ->Enquire ->Redeem Reward Points -> Select Card -> My Rewards -> Spend Promo Details

Published on 13

th

Aug 2024

• Once cardholder is eligible post achieving the target, voucher message will be triggered to registered phone

number & email ID within 30 working days.

• The voucher message triggered to the customer through SMS & Email will be valid and active only for 60

days from the triggered date.

• The cardholder needs to select from the available voucher options. He/she can choose by replying back to

the specified number with the option to get the voucher or visit the vendor page by clicking on the link

available in the message/email for selecting the voucher of his/her choice.

• The sample SMS which the card holder will receive: o Congrats! You are eligible for a Free Gift Voucher

worth INR 1000 on your HDFC Bank Millennia Credit Card.

To claim, SMS:

MILNIA A for Big Basket

MILNIA B for BookMyShow

MILNIA C for Pizza Hut

MILNIA D for PVR MILNIA

E for Uber

And send to 53030.

For more options, please visit www.gyftr.com/hdfcbankmillennia/

For any help, give a missed call at 7840089420

• The voucher once issued to the cardholder can’t be changed or reissued.

• The validity of the voucher will be applicable as per the selected voucher T&C.

• The voucher not utilized within the mentioned period will not be reissued.

Other Benefits –Terms & Conditions

• Welcome Benefit of 1000 CashPoints will be given to the cardholder if the joining membership fee is paid.

• There will be no cashpoints posting for renewal membership fee payments.

• 1% Fuel Surcharge waiver on fuel transactions (Minimum transaction of ₹400, Maximum transaction of

₹5,000 & Maximum waiver of ₹250 per statement cycle). The rate of surcharge may vary depending on the

fuel station and their acquiring bank. Taxes as applicable shall apply further. In any case, Bank shall be giving

a maximum waiver of 1% in case of any dispute, subject to limit applicable limits.

• Effective 1

st

December 2023, complimentary lounge access on domestic airports will no longer be available

on Millennia Credit Card.

Published on 13

th

Aug 2024

Important Changes in Charges:

Effective 1st August, 2024, the following revision to your HDFC Bank Credit card charges will apply.

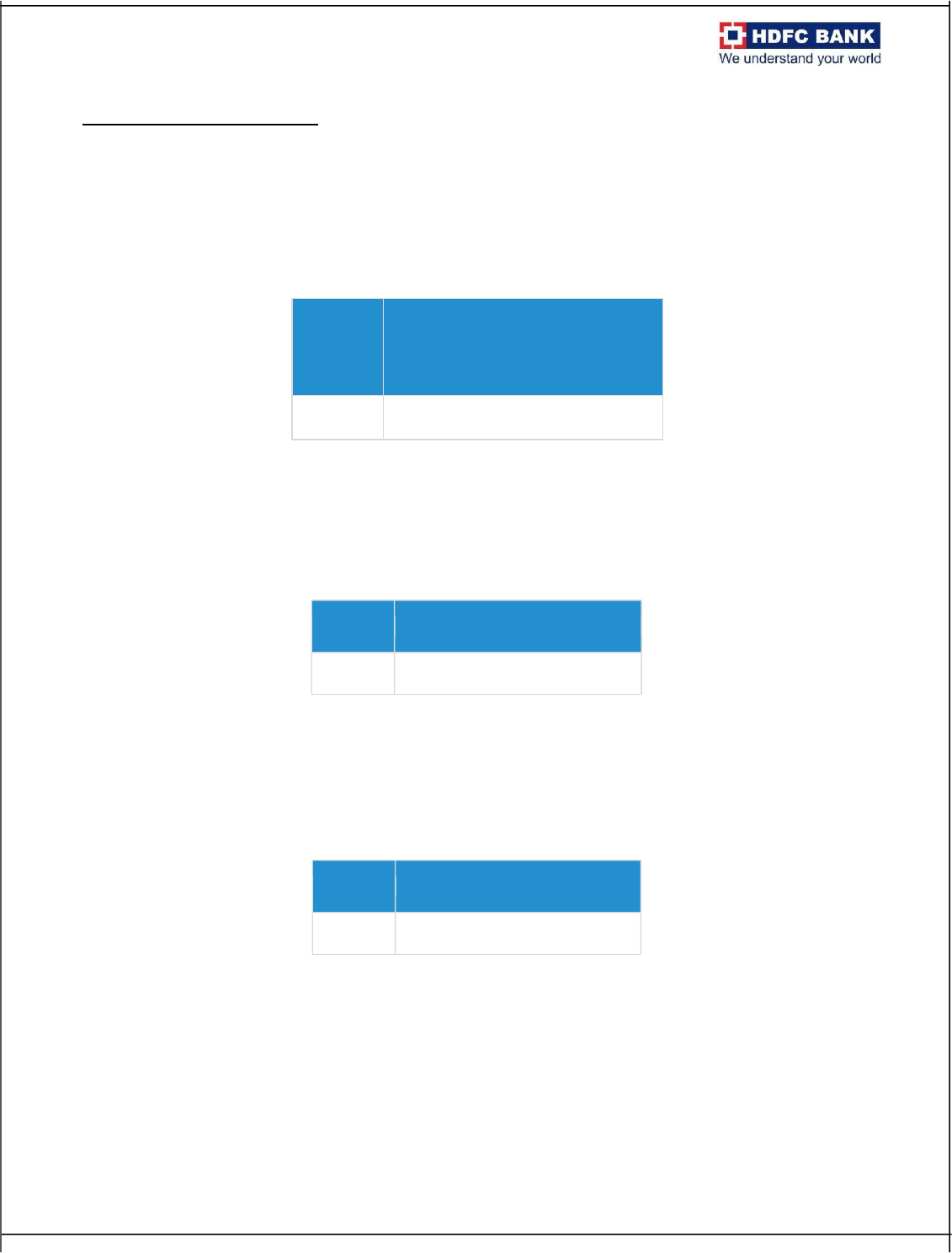

Rental Transactions:

If you use services like (but not limited to) CRED, PayTM, Cheq, MobiKwik, Freecharge, and others to

pay rent, a 1% fee will be charged on the transaction amount and capped at ₹3000 per transaction.

Category

Merchant Category Codes (MCC)

Rent

6513

Fuel Transactions:

If you spend less than ₹ 15000 per transaction on fuel, no additional fee will be charged. However, if

you spend more than ₹15,000 per transaction on fuel, a 1% fee will be charged on the entire amount

and capped at ₹3000 per transaction.

Utility Transactions:

If you spend less than ₹ 50,000 per transaction on Utilities, no additional fee will be charged.

However, if you spend more than ₹50,000 per transaction on utilities, a 1% fee will be charged on the

entire amount and capped at ₹3000 per transaction.

Insurance transactions will not be considered as Utility transactions and hence no charge will be applicable.

Educational Transactions:

If you make education payments through college/school websites or their POS machines, there will

be no fees. International education payments are excluded from this charge. However, on education

Category

Merchant Category Codes (MCC)

Fuel

1361,5172,5541,5542,5983,9752

Category

Merchant Cate

gory Codes (MCC)

Utility

4900

Published on 13

th

Aug 2024

payments through third-party apps like (but not limited to) CRED, PayTM, Cheq, MobiKwik and

others, a 1% fee will be charged and capped at ₹3000 per transaction.

Category

Merchant Category Codes (MCC)

Education

8211,8220,8241,8244,8249,8299

International / Cross Currency Transactions:

If you make an International / Cross currency transaction, a 3.5% markup fee will be applicable.

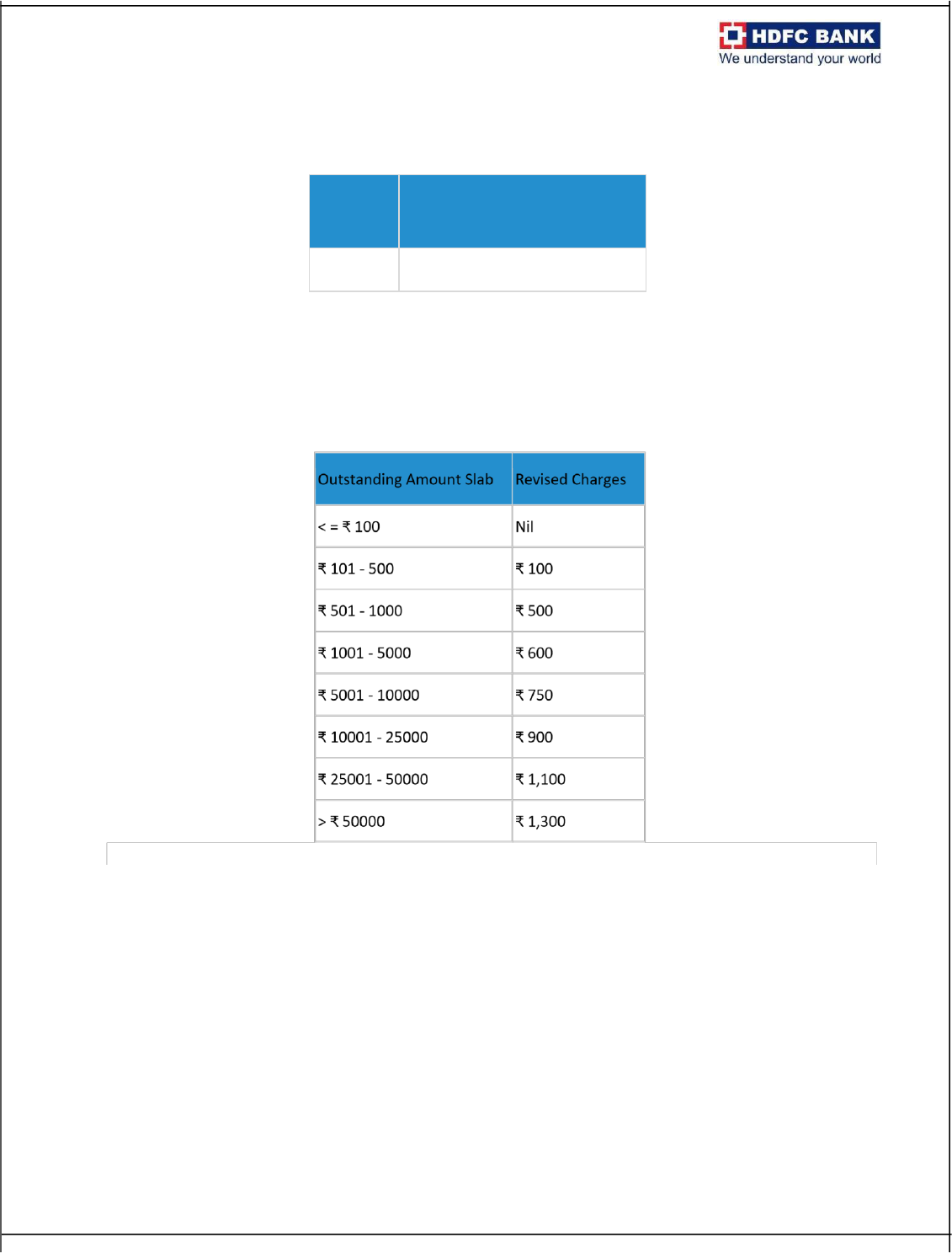

Our late payment fee structure has been revised as follows:

Finance Charges:

If you avail the revolving credit facility & hence choose to pay an amount less than the total amount

due reflected in the monthly billing statement, finance charges of 3.75% (per month) will be

applicable from the transaction date till the outstanding balance is paid in full. Applicable to all retail

& cash transactions.

Easy-EMI Processing Fee:

• If you avail the Easy-EMI option at any online / offline store, EMI processing fee of up to ₹299

will be charged.

Published on 13

th

Aug 2024

All fees are subject to GST as per government regulations.

The Merchant Category codes are defined by the network (Visa, Master Card, Rupay, Diners). HDFC

Bank does not define the merchant category.

CashPoints Redemption –Terms & Conditions

• CashBack will be given in the form of CashPoints, which can be redeemed by the customer against the

statement balance. The CashPoints will be posted as Reward Points only.

• Effective 1st August 2024, if you redeem your rewards towards statement credit (CashBack), a ₹50

redemption fee will be charged.

• The redemption against the statement balance will be at the rate of 1 CashPoint = ₹1, and can be done via

Net Banking login, Phone Banking, or physical redemption form.

• The minimum CashPoints balance required for redemption against the statement balance is 500 CashPoints.

• CashPoints can also be used for redemption against travel benefits like Flight & Hotel bookings and Rewards

Catalogue at the SmartBuy Rewards Portal, at a value of 1 CashPoint = ₹0.30

• For redemption against Flights and Hotels via SmartBuy, Credit Card members can redeem up to a maximum

of 50% of the booking value through Cash Points (1 CashPoint = ₹0.30). Rest of the transaction amount will

have to be paid via the HDFC Bank Credit Card

• With effect from 1st January 2023, Reward points redemption for flights & hotels bookings are capped per

calendar month at 50,000.

• Unredeemed CashPoints will expire/lapse after 2 years of accumulation.

• If the cardholder opts for redemption of the cashpoints via reward catalogue, there will be debit of

₹99+Taxes towards redemption handling charges.

• With effect from 1st February 2023, Reward points redemption for CashBack redemption are capped per

calendar month to 3,000 rewards points.

• With effect from 1st February 2023, cardmembers can redeem upto 70% of product/Voucher value through

Reward points on select vouchers/products and pay the remaining amount via Credit card.

For more/ latest product information, Most Important Terms & Conditions & Card Member Agreement, always refer

to the product page on the bank website www.hdfcbank.com.

• For quick access to Most Important Terms & Condition, please click here

• For quick access to Card Member Agreement, please click here

=================================================